Fundamental Analysis of AUD/USD for November 29, 2017

AUD/USD has been quite bearish recently rejecting off the dynamic level of 20 EMA after bouncing off from 0.75 support area. Despite the recent dovish economic reports and events, USD has been stronger than AUD which does explain the severe weakness of AUD in comparison to other currencies in the market. Recently FOMC Member Kaplan spoke about how the lower inflation and rapid rate hike can effect the growth of the economy in the long term and lead to Recession. USD has been quite dovish about the upcoming rate hike in December though it is quite confirmed. Today, USD Prelim GDP report is going to be published which is expected to show a growth to 3.3% from the previous value of 3.0%, Prelim GDP Price Index is expected to be unchanged at 2.2%, Pending Home Sales report is expected to show an increase to 1.1% from the previous value of 0.0%, Crude Oil Inventories is expected to have greater negative figure of -2.5M from its previous figure of 1.9M and FOMC Member Dudley and FED Chair Yellen is going to speak about the upcoming interest rate issues and policies whereas any positive outcome is expected to help with the gains of USD against AUD in the coming days. On the AUD side, today there were no economic events or reports to impact the market momentum but tomorrow AUD HIA New Home Sales report is going to be published which previously was at -6.1%, Private Capital Expenditure is expected to show an increase to 1.1% from the previous value of 0.8%, Building Approvals is expected to decrease to -0.9% from the previous value of 1.5% and Private Sector Credit is also expected to increase to 0.4% from the previous value of 0.3%. Most of the economic reports are expected to be quite positive in nature, whereas if the results meet expectations or do better then we might observe some corrective price action above the support area of 0.75. To sum up, USD is going to have some high impact economic reports and events today which is expected inject some volatility in the market whereas upcoming AUD economic reports are also quite positively forecasted which may help AUD to regain its momentum against USD. Currently, the market bias is quite neutral in nature but USD may have an edge of AUD if today’s economic events result in any positive outcome with the upcoming rate hike decision in December.

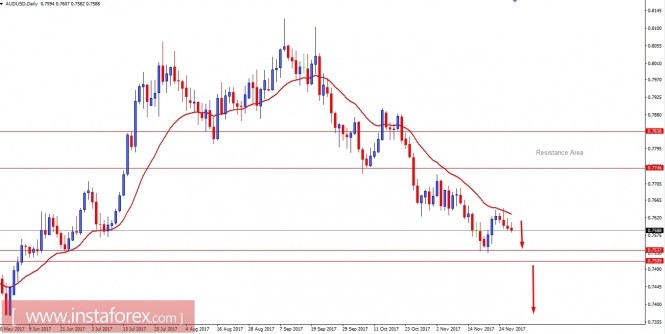

Now let us look at the technical view, the price is currently residing below the dynamic level of 20 EMA with confluence having lower highs along the way which is expected to reach 0.7500 support area soon. If the price breaks below 0.7500 support area with a daily close then further bearish pressure with the target towards 0.7350 is expected. As the price remains below the dynamic level of 20 EMA and 0.7600 area the bearish bias is expected to continue further.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Fundamental Analysis of AUD/USD for November 29, 2017