Fundamental Analysis of USD/CHF for February 2, 2018

USD/CHF has been quite impulsive with the bearish gains in the pair after breaking below the 0.9450 area with a daily close. Ahead of the high impact economic reports to be published today for the USD, the currency seemed to be quite weaker in comparison. Today, USD Average Hourly Earnings report is going to be published which is expected to decrease to 0.2% from the previous value of 0.3%, Non-Farm Employment Change is expected to increase to 181k from the previous figure of 148k and Unemployment Rate report is expected to be unchanged at 4.1%. Moreover, USD Revised UOM Sentiment report is going to be published today which is expected to have slight increase to 95.0 from the previous figure of 94.4, Factory Orders is expected to increase to 1.5% from the previous value of 1.3% and Revised UOM Inflation Expectation is expected to have a rise from the previous value of 2.8%. On the other hand, this week CHF Trade Balance report was published with an increase to 2.63B from the previous figure of 2.58B which was expected to be at 2.54B, KOF Economic Barometer report was published with a decrease to 106.9 from the previous figure of 111.4 which was expected to be at 110.9, UBS Consumption Indicators is expected to decrease to 1.69 from the previous figure of 1.73 and Credit Suisse Economic Expectations is expected to decreased to 34.5 from the previous figure of 52.0. Additionally CHF Retail Sales was also published with a worse than expected in value to 0.6% which was expected to 1.5%. As of the current scenario, despite having mixed economic reports this week CHF gained impulsive momentum against USD which does explain about the severe weakness of USD in the market. Ahead of the high impact economic reports to be published today on USD, certain retracement and pullback are expected in this pair before the price continues its journey much lower in the coming days.

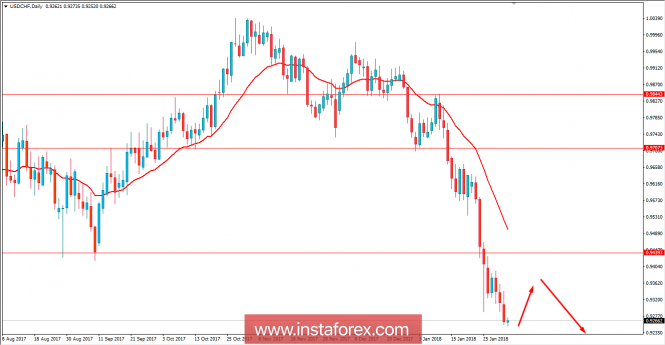

Now let us look at the technical view. The price is currently quite impulsive with the bearish pressure from where it is expected to show some retracement towards the 0.9450 area before proceeding much lower in the coming days. A certain amount of spike and volatility is expected to hit the pair today due to high impact USD economic reports to be published. As the price remains below 0.9450 the bearish bias is expected to continue with the target towards 0.90-91 support area in the coming days.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Fundamental Analysis of USD/CHF for February 2, 2018