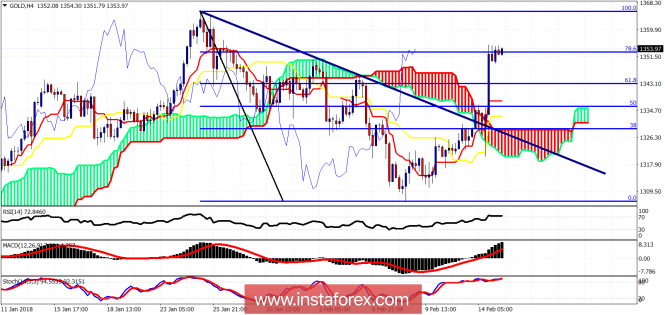

Ichimoku cloud indicator analysis of gold for February 15, 2018

Gold price reacted negatively after the CPI report yesterday, as Dollar strengthened, but very fast afterwards price reversed upwards and took back all its losses. Price was then trading at the $1,334 resistance are by our Kumo (cloud). As Dollar weakened, Gold price broke above next resistance at $1,344 and moved back above the $1,350 long-term resistance.

Blue trend line – resistance (broken)

Gold price broke above the 4 hour Ichimoku cloud turning short-term trend to bullish again. Price as we said yesterday was challenging the cloud resistance. After the CPI report came out, Gold pulled back towards the 4-hour kijun-sen support at $1,317 and bounced back up strongly above the cloud. The reversal together with the weakening of the Dollar has given Gold a big push higher towards $1,350.

Magenta – long-term resistance

Blue line – long-term support

Long-term trend remains bullish as price is above the Kumo (cloud). Gold price is back above the long-term resistance. This is a very bullish sign. Gold bulls need to hold above this level and continue higher towards $1,390 which is the next target. Support is at $1,335 and next at $1,326. A break below these levels, will be very bearish for Gold. So far bulls remain in control.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Ichimoku cloud indicator analysis of gold for February 15, 2018