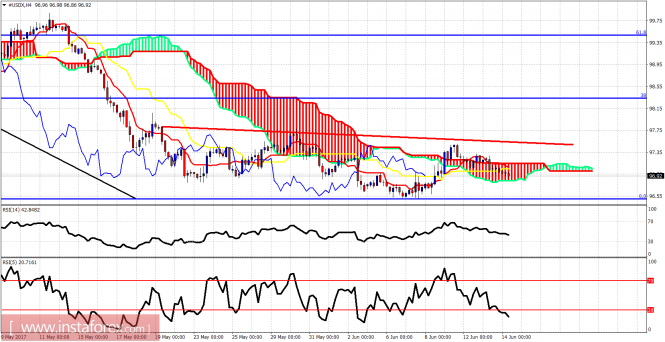

Ichimoku indicator analysis of USDX for June 14, 2017

The dollar index shows reversal signs but it is not reversing actually. The trend remains bearish. I continue to believe this is not the time to be go short. I still expect that the price will bounce towards 99 before moving towards low 90’s.

Red line – short-term resistance

The price has fallen back inside the 4 hour Kumo. The trend is neutral. Support is being tested now. Resistance remains at 97.50. A break above 97.50 will push the index much higher towards 98.50-99. The 38% Fibonacci retracement is the most probable first target for the bounce.

Blue lines – bearish channel

Red line – resistance trend line

The Dollar index continues to diverge and is very close to the lower channel boundary below the Daily Kumo and the 200 MA. The trend is clearly bearish and I continue to expect it to remain like this even after the strong bounce. I still think that a strong bounce should push price towards the daily Kumo and then reverse lower. The Dollar index is oversold at current levels.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Ichimoku indicator analysis of USDX for June 14, 2017