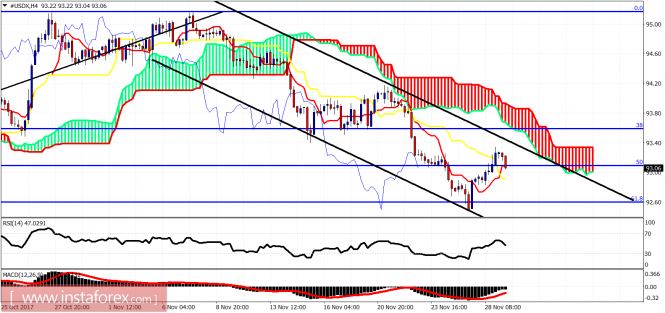

Ichimoku indicator analysis of USDX for November 29, 2017

The Dollar index remains inside the bearish channel and below the 4-hour Kumo (cloud). Trend remains bearish, however the bounce off the 61.8% Fibonacci retracement is an important sign that we should not ignore. Today’s pullback is expected to be short lived.

Black lines – bearish channel

The Dollar index bounced strongly yesterday and is now pulling back down. Support is at 92.93 and resistance at 93.40. I expect price to reverse to the upside and break above and out of the bearish channel and cloud resistance.

On a weekly basis, the Dollar index is showing reversal signs. A weekly close above 93.30 will be a very bullish sign. A weekly close below 92.80 will maintain the bearish trend for next week as well. Price is showing reversal signs off the 61.8% Fibo and over the next few weeks I believe it is more probable to see price move towards the weekly Kumo.The material has been provided by InstaForex Company – www.instaforex.com

Source:: Ichimoku indicator analysis of USDX for November 29, 2017