Intraday technical levels and trading recommendations for EUR/USD for June 12, 2017

Daily Outlook

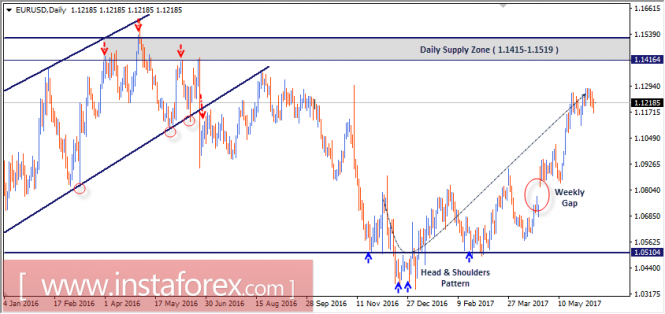

In January 2017, the previous downtrend was reversed when a Head and Shoulders pattern was established around 1.0500. Since then, evident bullish momentum has been expressed on the chart.

The next daily supply level to meet the EUR/USD pair is located between (1.1400-1.1520) where price action should be watched for possible bearish rejection.

Recent Update: The price levels around 1.1270-1.1285 constitute Intraday resistance where some bearish pullback is being expressed.

Bullish breakout above 1.1285 is needed to allow further bullish advance towards 1.1400.

H4 Outlook

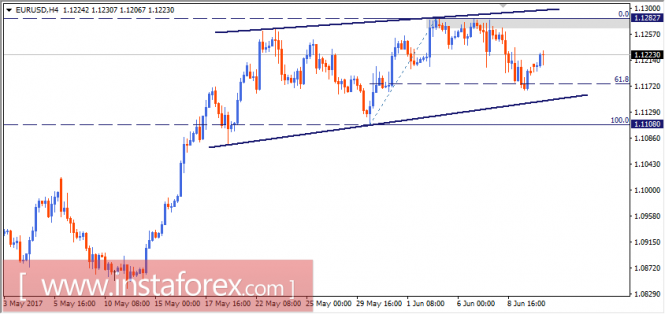

By the end of last week, significant bullish rejection was expressed around the price level of 1.1170 (Lower Limit of the wedge pattern in confluence with 61.8% Fibonacci Level ).

The nearest Supply level to meet the pair is located around 1.1280 (The upper limit of the wedge pattern) provided that the EUR/USD pair succeed to extend above 1.1225 (recent resistance level).

On the other hand, bearish fixation below 1.1170 enhances further bearish decline towards 1.1110 and 1.1070.

Trade recommendations:

The EUR/USD pair remains bullish initially towards 1.1400 unless evident signs of bearish rejection are expressed earlier around 1.1280. This hinders further bullish advance towards our mentioned entry level.

A valid SELL Entry can be considered at the depicted supply zone (1.1400 up to 1.1520). S/L should be placed above 1.1550 while T/P levels should be placed at 1.1100, 1.1020 and 1.0850.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Intraday technical levels and trading recommendations for EUR/USD for June 12, 2017