Japanese negative interest rates and options trading

Japan implemented negative interest rates on January 29th in an attempt to depreciate the value of its currency, increase exports and revive its economy. The USDJPY managed to climb to a high of 121.4820 by February 1st but since then the Yen begun to strengthen again, currently trading below 113.00.

This rally in the Japanese Yen has also coincided with continued volatility in the stock markets. In times of market stress, in the US especially, the Yen acts as a safe haven currency and tends to rise.

The Japanese economy however has not been in such a great shape recently and the GDP Growth rate for the last quarter was -0.4%. It also has one of the highest debt to GDP ratios in a developed economy at 230%.

There may be other factors in play such as capital flows. Foreign Bond & Stock investment data will be released Wednesday night at 11:50 pm. These two data indicate the capital flows of investors for Bonds and Stock respectively. Last week’s data showed a sharp increase of capital inflows for both investments. Foreign Bond investments for last week where ¥1,974.3 billion, this week’s forecast is for more positive flow of ¥403.53 billion. Any large deviations from these levels might create volatility in USDJPY price.

Tuesday at 15:00 GMT will see the release of ISM manufacturing PMI and ISM Prices Paid from the US, expected at 48.8 and 35.0 respectively. More importantly Friday Non-Farm Payrolls will be released at 13:30 GMT. The forecast for this number is 195k new jobs, last month’s figure was 151K, which had surprised the markets as the forecast had been above 200k.

These two data releases are important in that the ISM manufacturing data is a gauge for economic activity and Prices Paid is an indicator of inflation pressure. The Fed has mentioned various times that the factors it would be watching to determine monetary policy would be inflation and job creation. Given that both inflation and employment seem to be on the decline the chances of further interest rate increases near term are declining.

If you feel volatility will increase over the next week for this currency pair, then you may consider buying a Straddle. This is a strategy which consists of simultaneously buying a Call and a Put option with the same strike, expiry and for the same amounts. If volatility increases regardless of the direction of price this strategy is one to consider.

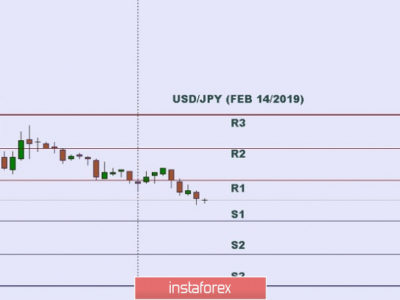

The screenshot below shows an example of a Buy Straddle position with strike 112.888, expiry 7 days and for $10,000 would cost $155.05, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above Buy Straddle strategy, which you will obtain by clicking on the scenarios button.

If on the other hand you feel that volatility will stay flat or decline over the next week, then you may consider selling a Straddle. This strategy consists of simultaneously selling a Call and a Put option with the same strike, expiry and for the same amounts.

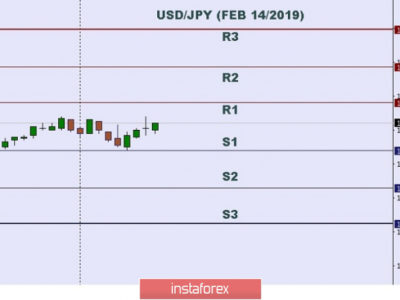

The screenshot below shows an example of a Sell Straddle strategy with strike 112.943, 7 day expiry and for $10,000 would create $138.63 of revenue with a total risk of $338.63.

This screenshot shows the profit and loss profile of the above Sell Straddle strategy.

The post Japanese negative interest rates and options trading appeared first on Forex.Info.

Source:: Japanese negative interest rates and options trading