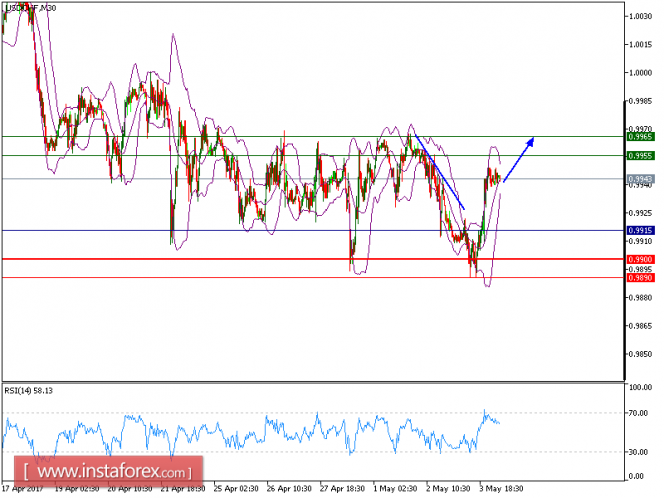

Technical analysis of USD/CHF for May 4, 2017

USD/CHF Intraday: Further upside. The pair accelerated on the upside after breaking above the declining trend line since May 1. The upward momentum is further reinforced by the rising 20-period and 50-period moving averages. The relative strength index is bullish, calling for a further advance.

The Federal Reserve, as expected, kept interest rates unchanged while playing down the recent spate of weak economic data. The statement following the central bank’s two-day policy meeting pointed out, “the committee views the slowing in growth during the first quarter as likely to be transitory the labor market has continued to strengthen even as growth in economic activity slowed. The fundamentals underpinning the continued growth of consumption remained solid. Business fixed investment firmed. Inflation measured on a 12-month basis recently has been running close to the Committee’s 2 percent longer-run objective.”

Hence, as long as 0.9915 is supported, look for a new challenge to 0.9955 and even to 0.9965 in extension.

Resistance levels: 0.9955, 0.9965, and 1.000

Support levels: 0.9900, 0.9890, and 0.9840

The material has been provided by InstaForex Company – www.instaforex.com