Technical analysis of USD/JPY for May 9, 2017

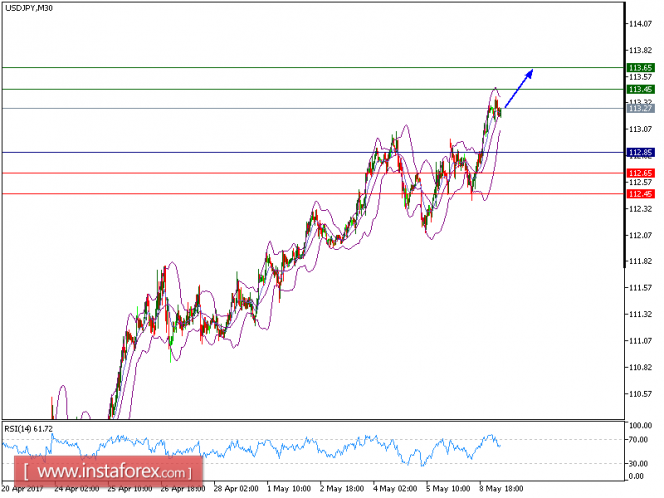

USD/JPY is expected to trade with a bullish outlook. The pair remains bullish above its nearest support at 112.85, and is likely to post a further advance. Both the 20-period and 50-period moving averages are turning up, and should call for a new bounce. Besides, the relative strength index is positive above its neutrality area at 50.

To sum up, as long as 112.85 is not broken, the pair is likely advance to 113.45 and then to 113.65.

The pair is trading above its pivot point. It is likely to trade in a wider range as long as it remains above its pivot point. Therefore, long positions are recommended with the first target at 113.45 and the second one at 113.65. In the alternative scenario, short positions are recommended with the first target at 112.65 if the price moves below its pivot points. A break of this target may push the pair further downwards, and one may expect the second target at 112.90. The pivot point lies at 112.85.

Resistance levels: 113.45, 113.65, and 113.85

Support levels: 112.65, 112.45, and 112.05

The material has been provided by InstaForex Company – www.instaforex.com