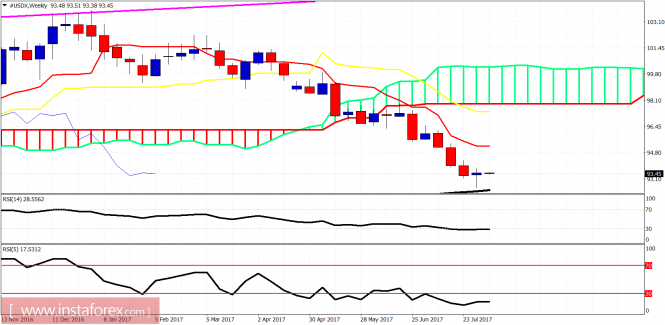

Technical analysis of USDX for August 7, 2017

The Dollar index bounced strongly on Friday after the announcement of the jobs report and specifically of the better than expected NFP. Short-term trend has changed to bullish as the price is now testing important intermediate term trend.

Magenda line – resistance

The Dollar index has broken above the resistance trend line and is making higher highs and higher lows. Price is now testing the important intermediate-term trend resistance level at 93.80. A pull back towards 93.20 is justified as this was the break out level. However, I believe that the time for a strong Dollar bounce has arrived. The weekly candle also could be confirming this view.

We have been saying for the past few sessions that the Dollar index is oversold, diverging, and inside the long-term support area of 92-93. Last week’s candle with the long tail and bullish close near the highs is a bullish reversal hammer pattern. If this week is positive and gives us a higher close, we will confirm the trend reversal that could push price towards even 98. I remain bullish the Dollar.The material has been provided by InstaForex Company – www.instaforex.com