Technical analysis of USDX for July 18, 2017

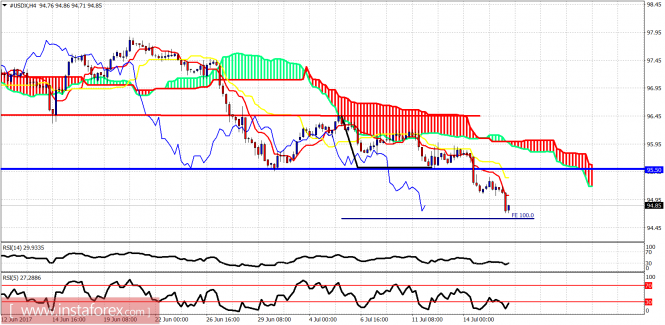

The Dollar index back tested the break down level at 95.50 and reversed back lower after being rejected at resistance. Price is now just above our 94.70 target.

Red line- resistance

Blue line – support (broken)

The trend is bearish. Target is 94.70 and was given once price broke below the blue horizontal support at 95.50. We were bearish since 96.30 where price could not break above the 4 hour Kumo. The trend has not changed since despite being given some weak signals of reversal. The reversal was never confirmed. On the contrary, the bearish trend signs were strengthened.

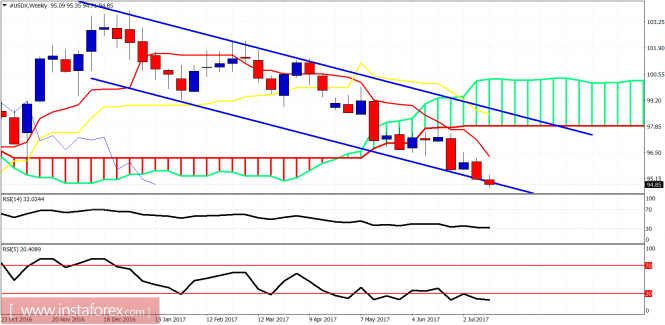

Blue lines – bearish channel

The Dollar index remains inside the weekly bearish channel and below the weekly Kumo. The RSI (5) is oversold and diverging. This is not a reversal signal but a warning. Do not think it is the same. The trend remains bearish and there is no confirmation of a bullish reversal in any time frame. I continue to expect a bounce but price action continues to favor bears.

The material has been provided by InstaForex Company – www.instaforex.com