Wednesday 6th August: Daily Technical Outlook and Review.

For the readers’ benefit:

Price action confirmation: Simply means traders will likely wait for price action to confirm a level by consuming an opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

EUR/USD:

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly timeframe: Price is currently trading within weekly demand at 1.32940-1.34847, and at the time of writing, a little interest is being seen by the sellers, however the buyers have been seen showing the lion’s share, if price is intent in trading higher, the first trouble area for the buyers seen on this timeframe is weekly supply at 1.36995-1.35844.

- Daily timeframe: Selling action has been seen out of the daily decision-point area at 1.34433-1.34202, judging by the looks of things here currently, we may be seeing a touch of the 1.33559 level, which in our opinion is a very important area to watch.

Price has smashed straight through the round number 1.34 leaving the majority of the buyers around this level possibly at a loss, The selling pressure must be relatively strong, as (at the time of writing) price did not even retest the round number after the break.

Things are beginning to get very interesting now, if price continues on south towards the low 1.33774 and breaks it, a highly likely touch of the daily level of interest will be seen at 1.33559 (seen clearer on the daily timeframe). The reasoning behind this is the green-dashed trendline, this is not to represent a trend, it’s more to show how when the buyers were rallying price, they were spiking south to collect buy orders for the original push up, that’s great, but what they also did was likely clear the path south for any sellers.

Therefore upon a successful break below the low 1.33774, keep an eye on the daily level of interest (level above) which is just below the low marked with an arrow at 1.33658. Regarding all of the above, do remember we are still in heavy weekly demand at 1.32940-1.34847, so do remain aware heavy buyers could in fact still come into the market at any time!

Pending/P.A confirmation orders:

- No pending buy orders (Green line) are seen in the current market environment.

- The P.A confirmation buy order (Red line) set just above the round number1.34 at 1.34048 has been removed since price traded too far below the entry level for the time being.

- Pending sell orders (Green line) are seen just below the D/S flip area (1.34760-1.34943) at 1.34753.The reasoning behind setting a pending sell order here was because this is the area we believe on this timeframe pro money sellers made the decision to push prices south into (what was at the time) 4hr demand at 1.33984-1.34404, with the possibility of unfilled sell orders still waiting there.

- The pending sell order (Green line) set just below a decision-point area (1.34428-1.34305) at 1.34266 is now active. Our first and second take-profit levels have both been hit (1.34/1.33846), so do keep an eye on our third and final take-profit level set at 1.33559.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

A strong push below the round number 1.34 has been seen with a retest yet to happen. If price continues south to the low 1.33774, and breaks it, we will very likely be seeing a touch of the daily level of interest at 1.33559 (seen on the daily timeframe).

- Areas to watch for buy orders: P.O: No pending buy orders are seen in the current market environment. P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 1.34753 (SL: 1.35031 TP: Dependent on price approach)1.34266 (Active) (SL: 1.34459 TP: [1] 1.34 [2] 1.33846 [3] 1.33559). P.A.C: No P.A confirmation sell orders are seen in the current market environment.

GBP/USD:

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly timeframe: A decline in value has been seen over the past few weeks within weekly supply at 1.76297-1.67702, which has seen price trade into weekly demand at 1.66917-1.67939. Buying interest is currently being seen out of this weekly demand area, if a push much higher from here happens, this could indicate potential weakness within the weekly supply area. However, a break below this weekly demand area will likely indicate selling strength and we should then at least expect lower prices down to around the weekly demand area at 1.64589-1.66339.

- Daily timeframe: Price has traded right into a daily demand area at 1.67367-1.68440 which is neatly located around the weekly demand area (levels above). A bit of buying interest has been seen out of this daily demand area; however it appears to be short lived, as active sellers seem to be coming into the market around the daily R/S flip level at 1.68963. If we see a break below the aforementioned daily demand area, this could indicate potential weakness from the weekly demand area (levels above).

Recent trading action gave the impression (in our opinion) that price was going to break below the 4hr demand area at 1.68013-1.68585; price has done the exact opposite. The buyers have been on full force pushing prices up to a small 4hr decision-point area at 1.68919-1.68789 where active selling is being seen at the moment.

Price action is currently trapped on the 4hr timeframe between the aforementioned small 4hr decision-point area and 4hr demand area. A break above the 4hr decision-point area and round number 1.69 would be a good sign buying strength is coming into the market, and conversely, a break below the 4hr demand area and round number 1.68 would likely indicate weakness in not only the daily demand area at 1.67367-1.68440 but also potentially the weekly demand area at 1.66917-1.67939 as well.

Pending/P.A confirmation orders:

- The pending buy order (Green line) set just above the decision-point area (1.68013-1.68585) at 1.68631 is now active, so do keep an eye on our first take-profit level set at 1.69214.

- Pending buy orders (Green line) are seen just above 4hr demand (1.67389-1.67561) at 1.67601. The reason for setting a pending buy order here is because if price reaches this far south, we are then located deep within not only weekly demand at 1.69917-1.67939, but also daily demand at 1.67367-1.68440 making it very likely we will see some sort of a reaction north here.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- Pending sell orders (Green line) are seen just below the decision-point area (1.69939-1.69663) at 1.69626. We have set a pending sell order here due this being the area pro money made the push below (what was at the time) 4hr demand at 1.69512-1.69708, so there may very well be unfilled sell orders left there.

- The P.A confirmation sell order (Red line) set just below a 4hr decision-point area (1.68919-1.68789) at 1.68747 is now active. Sellers will need to confirm this area by consuming some or most of the buyers around the 4hr demand area below at 1.68013-1.68585 for a pending sell order to be set.

Quick Recap:

A push out of 4hr demand at 1.68013-1.68585 has been seen up to a small 4hr decision-point area at 1.68919-1.68789. A break above this area and the round number 1.69 would possibly indicate buying strength from the higher-timeframe demand areas (Weekly: 1.66917-1.67939 Daily: 1.67367-1.68440), and conversely, a break below the aforementioned 4hr demand area and round number 1.68 would likely indicate weakness in not only the daily demand area at 1.67367-1.68440, but also potentially the weekly demand area at 1.66917-1.67939 as well.

- Areas to watch for buy orders: P.O: 1.68631 (Active) (SL: 1.67932 TP: [1] 1.69214 [2] 1.69497) 1.67601 (SL: 1.67314 TP: Dependent on price approach). P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 1.69626 (SL: 1.70063 TP: Dependent on price approach). P.A.C: 1.68747 (Active-awaiting confirmation) (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

AUD/USD:

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly timeframe: Price is still seen in a consolidation with the upper limits at 0.94600 and the lower around the 0.92046 area. Last week saw sellers becoming quite aggressive if we compare to the last three weekly candles. Could we see a drop down the lower limits of this consolidation area this week?

- Daily timeframe: A positive daily close below the 0.93208 level happened last week, with price later seen retesting it as resistance. Selling pressure is currently being seen from around this level, if a bigger move south is seen, we may see a push to the downside towards daily demand at 0.92046-0.92354.

The buyers have pushed prices very deep into the 4hr D/S flip area at 0.93208-0.93417, which has likely consumed most of the sellers in the process. Take a look at the approach price action took, notice the spikes dropping south while price was rallying higher, this could very well be pro money consuming demand for a move to the downside which appears to be starting now!

It is very possible, since some or most of the sellers have been consumed in the aforementioned 4hr D/S flip area that the breakout south of the daily range low (0.93208) could have well been a fakeout, and pro money may have used the 4hr decision point area at 0.92566-0.92736 to help facilitate this, hence we have now placed a pending buy order here at 0.92855 with a small stop below.

Pending/P.A confirmation orders:

- New pending buy orders (Green line) are seen just above the decision point area (0.92566-0.92736) at 0.92855. The reason we have set an order such as this here, is simply because we believe majority of the sellers have now been consumed around the 4hr D/S flip area at 0.93208-0.93417, so a pending buy order (level above) has been set awaiting a possible return.

- The P.A confirmation buy order (Red line) set just above the decision point area (0.92566-0.92736) at 0.92775 has now been removed. Buyers have now (in our opinion) consumed the majority of the sellers in and around the 4hr D/S flip area at 0.93208-0.93417, so a pending buy order can now be set.

- No pending sell orders (Green line) are seen in the current environment.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

A push up into the 4hr D/S flip area at 0.93208-0.93417 has been seen, and the sellers at the time of writing are beginning to show some healthy interest. If price continues south, we see no reason why price cannot at least hit the round number 0.93, and with some effort, the 0.92855 area which is located just below, and is where we have a pending buy order set at 0.92855.

- Areas to watch for buy orders: P.O: 0.92855 (SL: 0.92691 TP: Dependent on price approach). P.A.C: No P.A confirmation buy orders seen in the current market environment.

- Areas to watch for sell orders: P.O: No pending sell orders seen in the current market environment. P.A.C: No P.A confirmation sell orders seen in the current market environment.

USD/JPY:

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly timeframe: Price remains capped between the long-term weekly R/S flip level at 101.206, and the weekly supply area above at 105.432-104.065.

- Daily timeframe: The three spikes seen above the daily resistance level at 102.713 possibly consumed the majority of the sellers around this area, which likely cleared the path up to around daily supply at 104.104-103.802; however, price could see a sell off due to pro money liquidity requirements (not enough sellers to buy into) before this area gets hit. Two areas of demand where price could decline to have caught our eye, the first being a near-term daily S/D flip area at 101.962-102.257 which price is yet to hit, and the second, the dally demand area much lower at 100.747-100.967 before a stronger advance is seen, so do be prepared for this to possibly happen sometime soon.

Price action has made some new developments, before we discuss this though; a small snippet from the last analysis still remains very important and is crucial to remember:

Taking into consideration the bigger picture for a moment (at least on the daily timeframe), a bearish reversal is expected before one can expect higher prices. Now, we can assume a lot of buyers got stopped out around the 4hr S/D flip area at 102.584-102.505 with their stops being set just below, but would these sell orders (stops from traders attempting to go long) be enough liquidity for pro money to buy into to push prices much higher? That is the big question, we believe doubtful, as price has not even touched the daily S/D flip area at 101.962-102.257 on the daily timeframe yet (see above on the daily timeframe analysis for details). With this in mind, we are seriously looking at the 4hr decision-point area lower down at 102.027-102.080 where the sharp burst of buying began, and as added confluence, this area is beautifully located around the daily S/D flip area just mentioned, so all in all, a fantastic area to keep an eye on.

Adding on to the above, price action is currently seen testing the minor 4hr S/R flip level at 102.714 once again. The approach price took to get there is interesting and could well be a clue we are in fact going to see lower prices soon. The small green trend line placed on the chart is to show how pro money have likely consumed demand as they were rallying price (take a look at those beautiful tails/spikes), thus possibly clearing the path south in the process for the sellers. So, if we see a nice bearish reaction at the aforementioned 4hr S/R flip level, we are expecting lower prices to around the 4hr decision-point area lower down at 102.027-102.080. However, we are not saying price will drop like a rock to this area, we of course do expect the usual road bumps on the way to our destination.

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen just above the decision-point level (102.027-102.080) at 102.100. We have set a pending buy order here since this remains the place on this timeframe where pro money likely made the decision to push price up so aggressively, which indicates the strong possibility that unfilled buy orders may still be present and active here.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- No pending sell orders (Green line) are seen in the current market environment.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

The buyers are seen testing the minor 4hr S/R flip level once more at 102.714, if a healthy bearish reaction is seen from here, we expect to see lower prices towards 4hr decision-point area lower down at 102.027-102.080.

- Areas to watch for buy orders: P.O: 102.100 (SL: 101.971 TP: Dependent on price approach).P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: No pending sell orders are seen in the current market environment. P.A.C: No P.A confirmation sell orders are seen in the current market environment.

EUR/GBP:

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly timeframe: A bearish reaction has been seen as price hit weekly supply at 0.80328-0.79780, this could very likely mean we may be heading down to true weekly demand at 0.79631-0.78623, only time will tell though!

- Daily timeframe: Active sellers were certainly lurking around the daily S/R flip level at 0.79751 as price is seen dropping relatively hard from here at the moment back down to daily demand (which should be consumed of demand/buyers now) at 0.78862-0.79206. If this is indeed true, we could very likely see a push down to the daily demand area below at 0.78117-0.78533 sometime soon which will effectively bring us into heavy weekly demand at 0.76931-0.78623.

The sellers are on fire! Price has been heavily sold into a 4hr demand area at 0.79240-0.79408 where the buyers are yet to show any ‘serious’ interest at the moment.

The higher-timeframes appear to be indicating a more selling to the downside will be seen (see above). Before this happens though, a break below the aforementioned 4hr demand area has to happen first, if this does indeed happen, some serious selling action could be seen all the way down to fresh 4hr demand at 0.78320-0.78602 as the near term 4hr demand area at 0.78862-0.79048 has in our opinion been well and truly consumed of all demand.

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen just above demand (0.78602-0.78320) at 0.78641. The reasoning behind setting a pending buy order here is due to its current location on the higher timeframes. This 4hr demand area is just above daily demand at 0.78117-0.78533 and also just within the upper area of weekly demand at 0.76931-0.78623.

- The pending buy order (Green line) set just above a decision-point area (0.79240-0.79408) at 0.79427 is now active, so do keep an eye on our first take-profit level set at 0.79557.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- Pending sell orders (Green line) are seen just below a supply area (0.80264-0.80133) at 0.80110 as this area is beautifully located within daily supply at 0.80328-0.80024, and not to mention the round number 0.8 is begging to be faked up into the aforementioned 4hr supply area, think of all that liquidity for pro money!!

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

A hard push from the sellers has been seen down into 4hr demand at 0.79240-0.79408 where little buying interest is currently being seen. If a break below here happens, we may be in store for much lower prices down to around the fresh 4hr demand area at 0.78320-0.78602.

- Areas to watch for buy orders: P.O: 0.78641 (SL: 0.78288 TP: Dependent on price approach) 0.79427 (Active) (SL: 0.79215 TP: [1] 0.79557 [2] 0.79684 [3] 0.8). P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 0.80110 (SL: 0.80295 TP: Dependent on price approach)P.A.C: No P.A confirmation sell orders are seen in the current market environment.

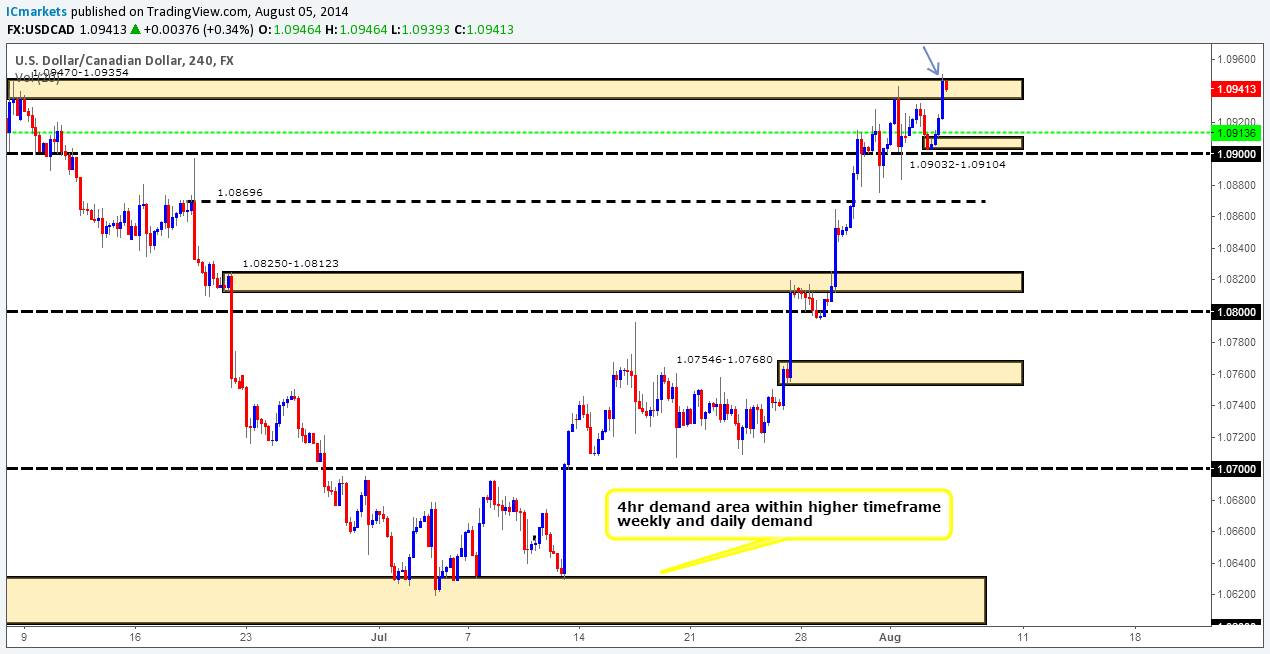

USD/CAD:

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly timeframe: The buyers look as though nothing will stop them as they are pushing price higher into weekly supply at 1.09592-1.08133. If we see a break of the weekly supply area, things will start to get very interesting as we believe the profit potential to the upside is huge.

- Daily timeframe: Price is seen trading deep within the daily supply area 1.09592-1.09156, a push above here could force prices to test daily supply at 1.10522-1.10133, but for the time being, price remains capped between daily supply at 1.09592-1.09156 and a daily S/R flip level below at 1.08277.

A spike/wick (marked with an arrow) has been seen above the 4hr decision-point area at 1.09470-1.09354 which likely has triggered a fair few stops in the process from traders trying to fade this area.

With some of the sellers likely consumed this likely means the path is now clear up to around the 4hr decision-point level at 1.09865 which is just above weekly supply at 1.09592-1.08133 and also above a daily supply area at 1.09592-1.09156, so things could get very interesting!

Before price likely attempts to trade to the 4hr decision-point level above, pro money may require liquidity as the sellers just stopped out above the 4hr decision point area at 1.09470-1.09354 now effectively bought into the market (Their stops would be buy orders once triggered), pro money cannot buy into buys! So they will likely sell down to the 4hr demand area at 1.09032.1.09104 to collect this much needed liquidity before pushing prices higher.

Pending/P.A confirmation orders:

- New pending buy orders (Green line) are seen just above 4hr demand (1.09032-1.09104) at 1.09136. The reason a pending buy order has been placed here, is because this 4hr demand area is where pro money likely made the decision to push prices above the 4hr decision-point area at 1.09470-1.09354 making this level very important indeed.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- The pending sell order (Green line) set just below a 4hr decision-point area (1.09470-1.09354) at1.09314 has been stopped out with a little profit locked in.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

A push above the 4hr decision-point area at 1.09470-1.09354 has been seen, which likely cleared the path up to a 4hr decision-point level at 1.09865. However before this happens, we have to be prepared for a retracement down to around the 4hr demand area at 1.09032-1.09104, as pro money may not have the required liquidity for a rally higher just yet.

- Areas to watch for buy orders: P.O: 1.09136 (SL: 1.08951 TP: Dependent on price approach).P.A.C: No P.A confirmation buy orders seen within the current market environment.

- Areas to watch for sell orders: P.O: No pending sell orders seen within the current market environment. P.A.C: No P.A confirmation sell orders seen within the current market environment.

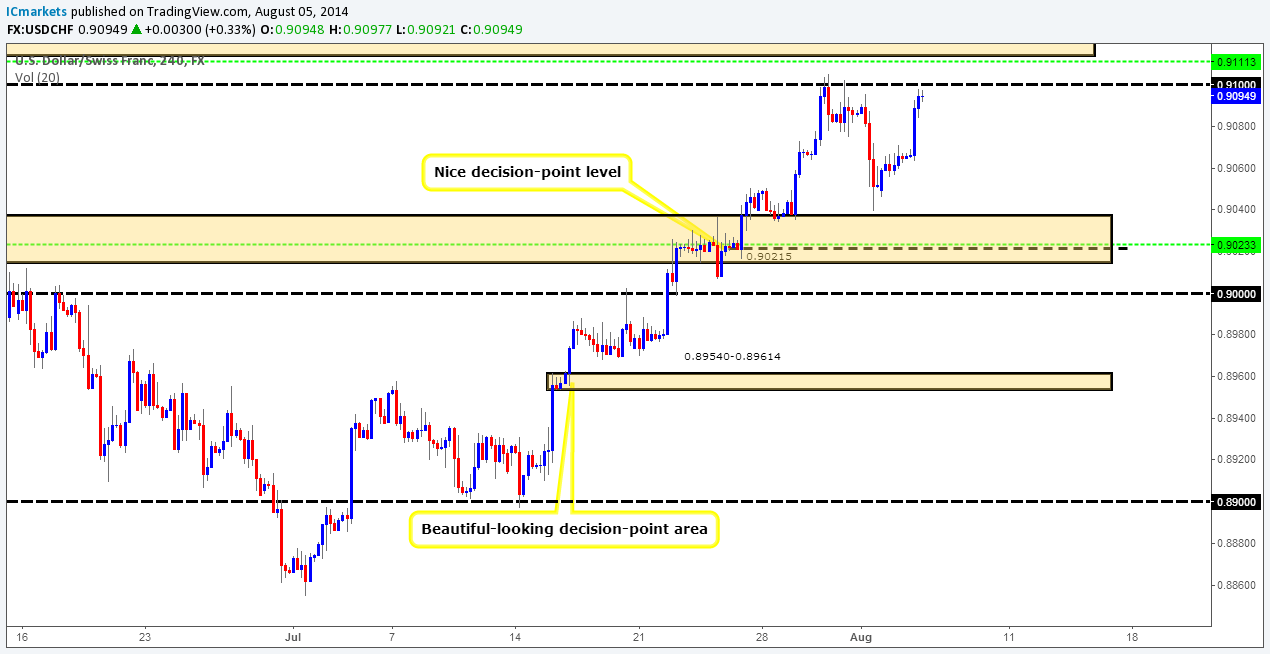

USD/CHF:

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly timeframe: Price is currently seen trading around the weekly decision-point level at 0.90927, could we possibly see lower prices from here?

- Daily timeframe: Buyers and sellers are seen trading between daily supply at 0.91556-0.90985 and a daily S/D flip area below at 0.90372-0.90042 with price trading just below the daily supply area at the moment. For the time being, on this timeframe we are going to wait for a break of either of the aforementioned areas, this will give us a good indication of where price is likely headed next.

Price is currently seen trading around the round number 0.91, which to us is a very important level because just above it is a beautiful 4hr supply area at 0.91329-0.91141. The round number here is begging to be faked past up to true 4hr supply, this would stop out most of the traders attempting to fade the round number, and give pro money their stops which would be then buy orders for pro money sellers to sell into!

Something else to consider with this trade is we are at a weekly decision-point level, and also trading just below a daily supply area (level above) making this a very confluent trade indeed!

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen just above the decision-point level (0.90215) at 0.90233. The reasoning behind placing a pending buy order here is simply because this is the area on the 4hr timeframe where pro money buyers likely made the decision to break above the 4hr supply area at 0.90372-0.90148, hence the possibility there may still be unfilled buy orders lurking around this level.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- Pending sell orders (Green line) are seen just below the 4hr supply area (0.91329-0.91141) at 0.91113. The reason we have placed an order such as this is due its higher-timeframe location (Weekly decision-point level 0.90927).

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

The buyers have pushed price up to the around the round number 0.91, a push above this level into 4hr supply at 0.91329-0.91141 (where we have a pending sell order set just below at 0.91113) is likely to be seen, where active sellers are likely waiting.

- Areas to watch for buy orders: P.O: 0.90233 (SL: 0.90117 TP: Dependent on price approach).P.A.C: No P.A confirmation buy orders seen in the current market environment.

- Areas to watch for sell orders: P.O: 0.91113 (SL: 0.91359 TP: Dependent on price approach).P.A.C No P.A confirmation sell orders seen in the current market environment.

XAU/USD:

4hr TF.

The higher-timeframe picture resembles the following:

- Weekly timeframe: Price still remains capped between weekly supply at 1391.97-1328.04 and a nice-looking weekly decision-point level below at 1244.08. The sellers appear in control at the moment, which should be the case really, as price has just recently traded out of the aforementioned weekly supply area.

- Daily timeframe: The sellers seem to really like the daily S/R flip level at 1292.52, as price reacted lovely off of it, and at the moment appear to be steaming south towards a major daily S/R flip level at 1277.36.

Price was unable to consume the high marked with a green flag at 1297.20. Instead, price is seen trading south and once again testing the 4hr S/D flip area at 1284.77-1280.53. If we see a break below here (which is likely considering we are trading off of a daily S/R flip level at 1292.52), price may very likely drop down towards a 4hr demand area at 1258.40-1264.53 which is quite a way below current price at the moment, but definitely an area to be noted down for future trading opportunities.

Pending/P.A confirmation orders:

- New pending buy orders (Green line) are seen just above 4hr demand (1258.40-1264.53) at 1266.09. The reason a pending buy order has been set here, is because this area in our opinion remains the overall origin of a big rally to the upside, likely meaning there are a lot of unfilled buy orders siting in and around this area.

- The P.A confirmation buy order (Red line) set just above the S/D flip area (1284.77-1280.53) at 1285.71 is now active, the buyers will need to prove this area by consuming some or most of the sellers around the high marked with a green flag at 1297.20, a pending buy order will then be set awaiting a possible return.

- No pending sell orders (Green line) are seen in the current market environment.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Quick Recap:

The sellers are currently seen testing the 4hr S/D flip area at 1284.77-1280.53 again, if we see a break below this area, a decline in price down to 4hr demand at 1258.40-1264.53 could well happen, which is where we currently have a pending buy order set just above at 1266.09.

- Areas to watch for buy orders: P.O: 1266.09 (SL: 1256.40 TP: Dependent on price approach). P.A.C: 1285.71 (Active-awaiting confirmation) (SL: Dependent on price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: No pending sell orders seen in the current market environment. P.A.C: No P.A confirmation sell orders seen in the current market environment.