Brent: East is a delicate matter

Donald Trump’s statement that “the mission is carried out” after the military strikes against Syria by the United States and its allies allowed the “bears” of Brent and WTI to go on a counterattack. The conflict around Damascus did not turn into a mass brawl and the risks of interruptions in supplies from the Middle East declined, which led to the removal of oil futures from the region of 3.5-year highs. However, fears about the resumption of economic sanctions against Iran, political instability in Venezuela, OPEC’s readiness to expand its commitments beyond 2018, and a strong global demand set the fans of black gold in a major way. In addition, who will give his head to be cut-off to guarantee that the US president will not throw out another fortune?

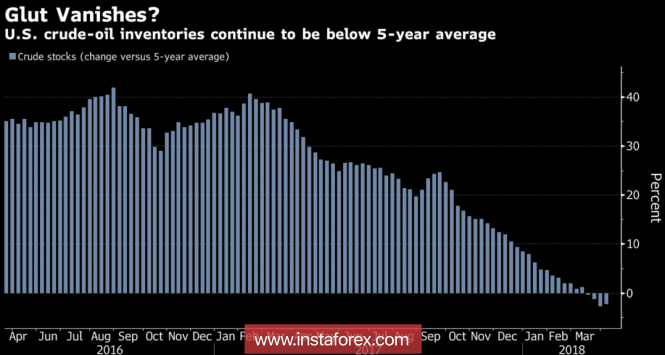

Theoretically reducing the degree of geopolitical risks opens the way for correction. “Bears” are waiting for their hour, guided by the growth of American production by about a quarter from mid-2016 to 10.53 million bpd and the increase in drilling rigs by 73 units from the beginning of the year. The dynamics of indicators indicates that US companies are actively developing production and simultaneously hedging price risks through the sale of futures contracts. The problem is that the decline in stocks indicates the outpacing dynamics of domestic demand. According to the forecasts of experts in Bloomberg, by the end of the week of April 13, oil reserves in the USA will have decreased by 600 thousand barrels and for the first time in the last few years, will have fallen below their five-year average.

Dynamics of US stocks

Thus, the large-scale fiscal stimulus favorably affects domestic demand and allows to cover the negative from the increase in production. The increased interest in black gold in other countries, coupled with the implementation of the Vienna agreements of OPEC, lays a solid foundation under the upward trend for Brent and WTI. Thus, the volume of oil refining in China in March set a new record of 12.13 million bpd. The previous one was recorded in November (12.03 million). The acceleration of the indicator compared with the average for the first two months of the year (11.56 million) and March 2017 (11.19 million) speaks of the growing appetite of the Celestial Empire. The volume of its domestic extraction of black gold is 3.76 million bpd. The indicator is wandering near the lowest mark since June 2011, and its dynamics convince that Beijing is actively buying oil abroad.

The situation can be changed only by the large-scale trade war between the US and China. This is the opinion of the International Energy Agency. Nevertheless, it does not change its forecast for the increase in global demand for 2018 at 1.5 million bpd. This shows that the IEA does not believe in military action. In our opinion, if the world economy headed by the US is beginning to restore the growth rates taken in 2017. The increased interest in oil will allow the “bulls” of Brent to continue the northern trend.

Technically, the April update of the maximum will increase the risks of implementation of the Targets by 161.8% and 200% in the AB = CD patterns. They are located near the marks of $ 75-76.5 per barrel.

Brent, daily chart

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Brent: East is a delicate matter