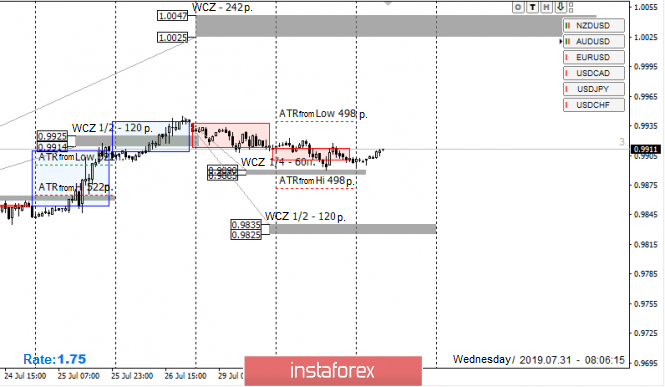

Control zones of USD/CHF pair on 07/31/19

The first support in the form of 1/4 WCZ of 0.9890-0.9885 was tested yesterday, which led to an increase in demand. Purchases made after the specified test should be transferred to breakeven after updating the weekly maximum. Further growth is possible before the weekly CZ of 1.0047-1.0025, which gives a very favorable ratio of risk to profit.

Working in the upward direction is the priority since a reversal pattern was formed.

An alternative model is to obtain better prices for the purchase. Reduction to the a WCZ of 0.9835-0.9825 will allow considering purchases at more favorable prices. his model will be formed only if the closure of today’s US session happens below 0.9885. The 1/2 WCZ is outside of the average day course, so it will take two days or more to test it.

Daily CZ – daily control zone. The area formed by important data from the futures market, which changes several times a year.

Weekly CZ – weekly control zone. The area formed by marks from the important futures market, which changes several times a year.

Monthly CZ – monthly control zone. The area is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company – www.instaforex.com