Fractal analysis of main currency pairs on July 10, 2020

Forecast for July 10 :

Analytical review of currency pairs on the scale of H1:

The key levels for the euro / dollar pair on the H1 scale are: 1.1371, 1.1317, 1.1292, 1.1257, 1.1224, 1.1182 and 1.1154. Here, the price forms the potential for the downward movement of July 9th. The continuation of the downward movement is expected after the breakdown of the level of 1.1257. In this case, the target is 1.1224. Price consolidation is near this level. The breakdown of the level of 1.1222 will lead to a pronounced downward movement. Here, the goal is 1.1182. For the potential value for the bottom, we consider the level of 1.1154. Upon reaching which, we expect consolidation, as well as an upward pullback.

A short-term upward movement is possible in the range of 1.1292 – 1.1317. The breakdown of the last level will lead to the formation of a local structure for the top. Here, the potential target is 1.1371.

The main trend is the upward structure of July 1, the formation of potential for the downward movement of July 9

Trading recommendations:

Buy: 1.1292 Take profit: 1.1315

Buy: 1.1319 Take profit: 1.1370

Sell: 1.1255 Take profit: 1.1226

Sell: 1.1222 Take profit: 1.1184

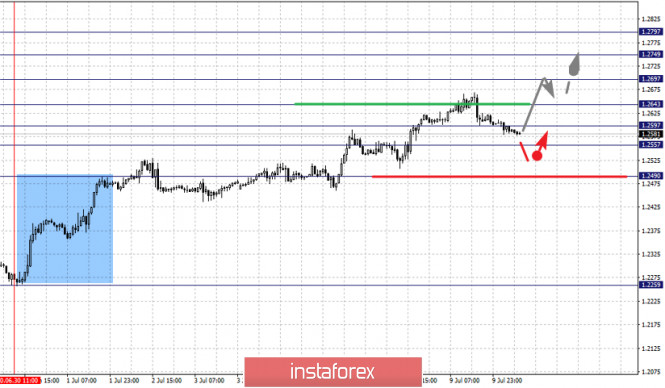

The key levels for the pound / dollar pair on the H1 scale are: 1.2797, 1.2749, 1.2697, 1.2643, 1.2597, 1.2557 and 1.2490. Here, we are following the development of the upward cycle of June 30. The continuation of the upward movement is expected after the breakdown of the level of 1.2643. In this case, the target is 1.2697. Price consolidation is near this level. The breakdown of the level of 1.2698 will lead to movement up to 1.2749. There is a high probability of a reversal to correction from this value. For the potential value for the top, we consider the level of 1.2797.

A short-term downward movement is expected in the range of 1.2597 – 1.2557. The breakdown of the last level will lead to a deeper correction. Here, the target is 1.2490. This is a key support level for the top.

The main trend is the upward structure of June 30

Trading recommendations:

Buy: 1.2644 Take profit: 1.2695

Buy: 1.2698 Take profit: 1.2747

Sell: 1.2596 Take profit: 1.2558

Sell: 1.2555 Take profit: 1.2492

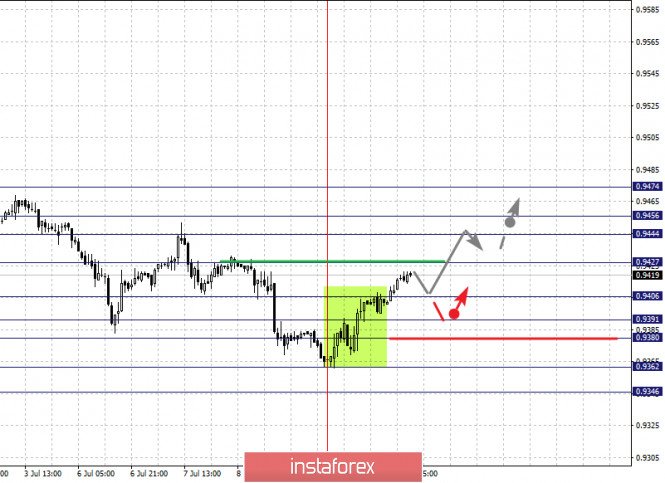

The key levels for the dollar / franc pair on the H1 scale are: 0.9474, 0.9456, 0.9444, 0.9427, 0.9406, 0.9391, 0.9380, 0.9362 and 0.9346. Here, the price is in correction from the downward structure and forms the potential for the top of July 9th. The continuation of the upward movement is expected after the breakdown of the level of 0.9427. In this case, the target is 0.9444. Price consolidation is in the range of 0.9444 – 0.9456. For the potential value for the top, we consider the level of 0.9474. Upon reaching this level, we expect a downward pullback.

A correction can be possibly avoided after the breakdown of the level of 0.9406. In this case, the target is 0.9391. The range of 0.9391 – 0.9380 is the key support and the price passing this range will lead to the subsequent development of the downward trend. In this case, the target is 0.9362. We consider the level of 0.9346 as a potential value for the bottom.

The main trend is the descending structure of June 30, the formation of potential for the top of July 9.

Trading recommendations:

Buy : 0.9428 Take profit: 0.9444

Buy : 0.9456 Take profit: 0.9474

Sell: 0.9406 Take profit: 0.9391

Sell: 0.9380 Take profit: 0.9362

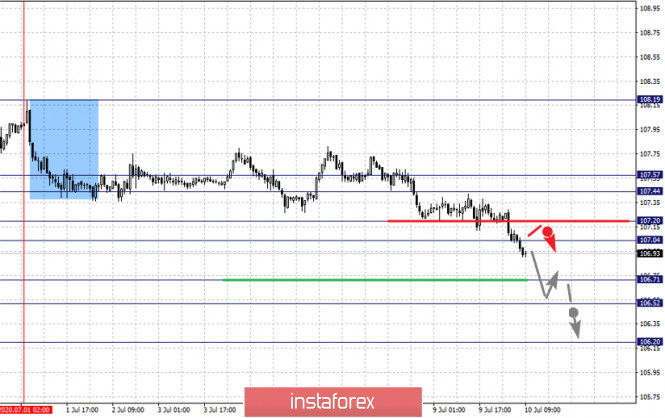

The key levels for the dollar / yen pair on the scale are : 107.57, 107.44, 107.20, 107.04, 106.71, 106.52 and 106.20. Here, we are following the descending structure of July 1 as the main structure. At the moment, we expect movement to the level of 106.71. Upon reaching which, we expect consolidation in the range of 106.71 – 106.52. For the potential value for the bottom, we consider the level of 106.20. We expect an upward pullback upon reaching this level.

A short-term upward movement is possible in the range of 107.04 – 107.20. The breakdown of the last level will lead to a deeper movement. Here, the target is 107.44. The range of 107.44 – 107.57 is a key support for the downward structure and it is possible to formulate the initial conditions for the top.

The main trend is the descending structure of July 1

Trading recommendations:

Buy: 107.04 Take profit: 107.20

Buy : 107.22 Take profit: 107.44

Sell: 106.69 Take profit: 106.53

Sell: 106.51 Take profit: 106.20

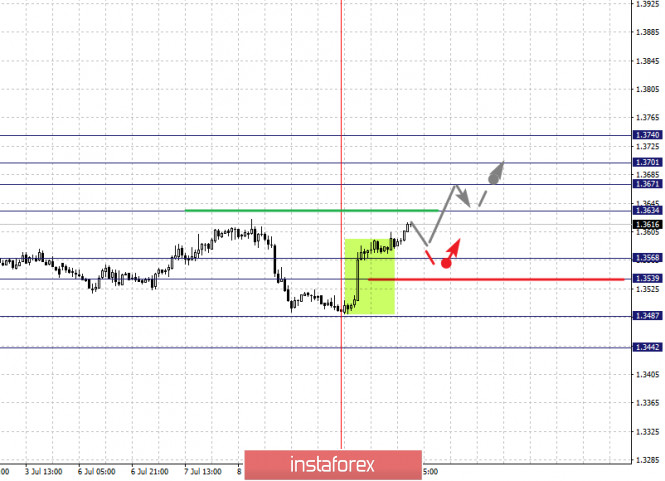

The key levels for the Canadian dollar / US dollar pair on the H1 scale are: 1.3740, 1.3701, 1.3671, 1.3634, 1.3568, 1.3539, 1.3487 and 1.3442. Here, the price forms the potential for the top of July 9th. The continuation of the upward movement is expected after the breakdown of the level of 1.3634. In this case, the target is 1.3671. A short-term upward movement, as well as consolidation are in the range of 1.3671 – 1.3701. For the potential value for the top, we consider the level of 1.3740. Upon reaching which, we expect a downward pullback.

A short-term downward movement is possible in the range of 1.3568 – 1.3539. The breakdown of the last level will lead to the formation of a local downward structure. Here, the potential target is 1.3487. For the potential value for the bottom, we consider the level of 1.3442.

The main trend is the local descending structure of July 8, the formation of potential for the top of July 9

Trading recommendations:

Buy: 1.3635 Take profit: 1.3671

Buy : 1.3673 Take profit: 1.3700

Sell: 1.3568 Take profit: 1.3540

Sell: 1.3537 Take profit: 1.3488

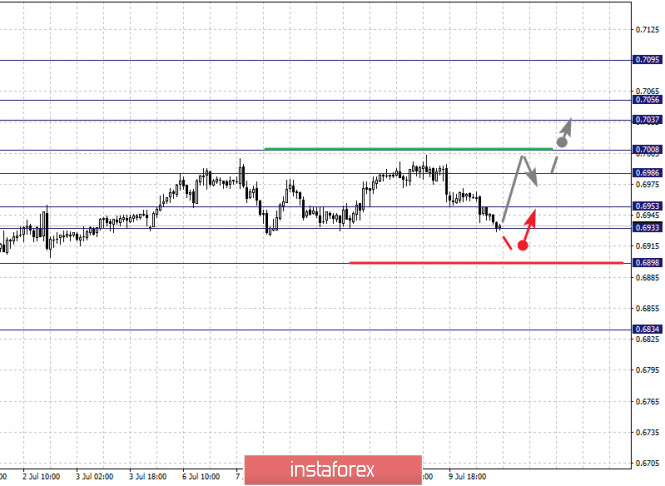

The key levels for the Australian dollar / dollar pair on the H1 scale are : 0.7095, 0.7056, 0.7037, 0.7008, 0.6986, 0.6953, 0.6933 and 0.6898. Here, we are following the upward cycle of June 30. A short-term upward movement is expected in the range 0.6986 – 0.7008. The breakdown of the last level should be accompanied by a pronounced upward movement. Here, the target is 0.7037. Price consolidation is in the range of 0.7037 – 0.7056, and hence, the probability of a downward turn is high. For the potential value for the top, we consider the level of 0.7095. Upon reaching which, we expect a downward pullback.

A consolidated movement is possible in the range 0.6953 – 0.6933. The breakdown of the last level will lead to a deeper correction. Here, the target is 0.6898. This is a key support level for the top.

The main trend is the upward cycle of June 30, the correction stage

Trading recommendations:

Buy: 0.6987 Take profit: 0.7006

Buy: 0.7010 Take profit: 0.7037

Sell : Take profit :

Sell: 0.6932 Take profit: 0.6900

The key levels for the euro / yen pair on the H1 scale are: 121.93, 121.38, 121.03, 120.76, 120.01, 119.74, 119.32 and 119.10. Here, the price forms the potential for the downward movement of July 9th. A short-term downward movement is possible in the range 120.01 – 119.74. The breakdown of the last level should be accompanied by a pronounced downward movement. Here, the target is 119.32. Price consolidation is in the range of 119.32 – 119.10.

A short-term upward movement is possible in the range of 120.76 – 121.03. The breakdown of the last level will lead to a deeper movement. Here, the target is 121.38. This is a key support level for the bottom and its breakdown will lead to the formation of a local upward structure. In this case, the potential target is 121.93.

The main trend is the formation of potential for the bottom of July 9

Trading recommendations:

Buy: 120.76 Take profit: 121.01

Buy: 121.05 Take profit: 121.36

Sell: 120.01 Take profit: 119.76

Sell: 119.72 Take profit: 119.34

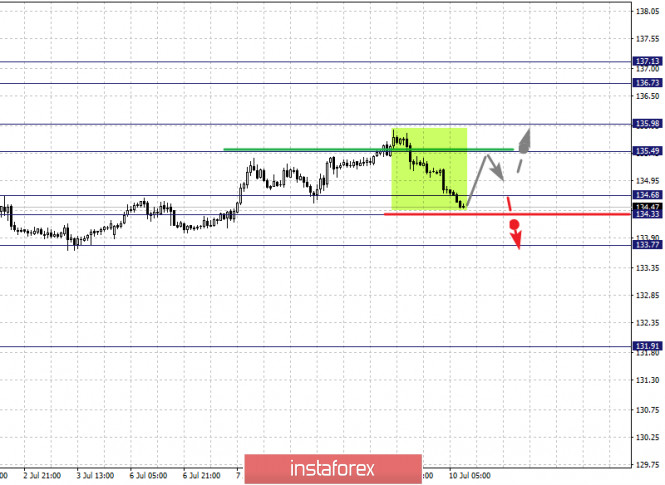

The key levels for the pound / yen pair on the H1 scale are : 137.13, 136.73, 135.98, 135.49, 134.68, 134.33 and 133.77. Here, we are following the development of the ascending structure of June 29. At the moment, the price is in correction. A short-term upward movement is expected in the range of 135.49 – 135.98. The breakdown of the last level will lead to a pronounced upward movement. Here, the target is 136.73. For the potential value for the top, we consider the level 137.13. Upon reaching which, we expect consolidation, as well as a downward pullback.

A consolidated movement is expected in the range of 134.68 – 134.33. The breakdown of the last level will lead to a deeper correction. Here, the goal is 133.77. This is a key support level for the top.

The main trend is the upward structure of June 29, the correction stage

Trading recommendations:

Buy: 135.50 Take profit: 135.96

Buy: 136.00 Take profit: 136.70

Sell: Take profit:

Sell: 134.31 Take profit: 133.78

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Fractal analysis of main currency pairs on July 10th