Euro Bounces on Stronger Than Expected Sentiment

The Euro has rebounded to the top end of a consolidating range, but the downtrend is still intact as the currency pair forms a bear flag pattern. Confidence rose in March in Germany, which continues to help propel the German stock market. Inflation on the other hand still remains relatively subdued.

German ZEW investor confidence rose to 54.8 in March from 53.0 in the previous month. The improvement over the month was weaker than expected and the ZEW highlighted that developments in the Ukraine as well as the tensions with Greece dampened sentiment, while investors are optimistic about the domestic economy. Overall sentiment levels are at a very high level and the current conditions indicator jumped to 55.1 from 45.5. Indeed, the March reading meant the ZEW jumped to 52.1 in Q1 from 14.3 in Q4 last year which backs the increasingly optimistic view on the German growth outlook, which will also lift overall Eurozone growth prospects.

Eurozone Feb HICP was confirmed at -0.3% year over year, as expected. The rise from -0.6% year over year was mainly due to less negative base effects from energy prices and higher food prices. Core inflation was revised up to 0.7% year over year from 0.6% reported initially. The core rate is still far below the ECB’s 2% limit for price stability, but the numbers highlight that lower energy prices are the sole reason for the negative headline rate. With growth picking up, the EUR falling sharply and the ECB adding further stimulus, the risks to the medium term inflation outlook are starting to be tilted to the upside and there is the risk of asset price bubbles building up in an environment of extremely low interest rates.

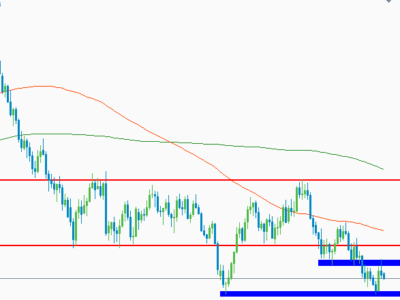

The EUR/USD edged higher and is poised to test resistance near the 10-day moving average at 1.0735. A close above this level would then target former support at 1.1115. The RSI (relative strength index) has turned higher with price action reflecting accelerating positive momentum, bouncing at former support while continuing to print at 28, which is below the oversold trigger level of 30 and could foreshadow a correction.

The post Euro Bounces on Stronger Than Expected Sentiment appeared first on Forex Circles.