USDJPY displays resilience while the EURUSD consolidates

Heading into 2015 the JPY was my pick for currency to surprise traders this year, and so far the currency has managed to hold its strength and consolidate against the USD despite the Greenback touching milestone highs against most of its trading partners. The major reason I thought that the excessive JPY weakness we saw during the last few months of 2014 would pause throughout the opening half of this year is because the Japanese economy will probably benefit the most from the dramatic decline in the price of oil.

Some view Abenomics as a failed monetary framework, although I find this unfair because no matter how weak the JPY was being driven in order to enhance inflation and export competitiveness, the economy was always being hammered by huge import costs as a consequence of having to import high levels of fuel following the Fukushima disaster. These fuel costs have reduced substantially, and with Japanese inflation data remaining relatively consistent despite the decline in the price of oil, the JPY is no longer under as much pressure to be weakened. The upside risks for the USDJPY are still present for the second half of this year, however I am not expecting the pair to reach the 124 area until the Federal Reserve actually begin raising US interest rates. For now the Bank of Japan’s (BoJ) QE stimulus is fully priced into the JPY and it is going to require US interest rate hikes to drive the USD even further, while extending the USDJPY.

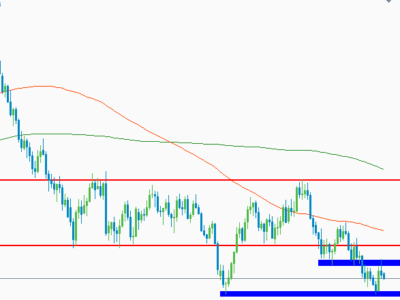

After extending down to a 12-year low at 1.0461, the EURUSD has managed to consolidate back towards the 1.06 area. However, the key point here is that this is just a consolidation while the markets remain cautious before the FOMC statement is released on Wednesday evening. As far as I am concerned, the move to parity is appearing inevitable and it could happen as soon as next month if the next US Non-Farm Payroll report elevates further pressure on the Federal Reserve to begin raising US interest rates. Anxiety over the European economy facing issues such as stagnant economic growth and dangerously low inflation levels, which played such a pivotal role in the ECB launching QE have not been priced into the Euro, meaning that further inspired USD demand will be the major factor in determining when the Eurodollar reaches parity.

Basically, the ECB launching QE means that the central bank is entering a new era of monetary easing by its own ultra-loose standards and another reason to expect continued currency weakness. As a result of this, the outlook for the Euro will remain rather bleak until the third or fourth quarter of this year where it will be hoped that a combination of the dramatically weaker euro and the ECB stimulus measures will help economic fortunes. One thing to point out is that although the outlook for the Euro is extremely bleak, European stocks hold opportunities. Unconventional easing measures by central banks are seen as providing cheap money to investors and this has set a trend of raising stock markets in the past. The German DAX is the one to look out for because not only has it touched record-highs in recent sessions but it will benefit from ECB QE and investors directing capital into European markets. I personally think that the DAX will continue adding further extensions to the 40% gains encountered over the previous six-months.

The pause in the EURUSD pressure has correlated in a similar reaction to the USDCHF, which makes me question even further if the Swiss National Bank (SNB) has privately set a new minimum exchange rate against the Euro. Perhaps questions over whether this is happening will remain unanswered for some time, however I am still expecting CHF weakness to remain a continued trend. The comments from SNB President that the CHF was clearly overvalued a fortnight ago illustrates to me that the central bank will consider even further monetary easing in the future.

In line with expectations, Gold is continuing to consolidate between the $1150 and $1160 area while traders show caution towards investments as they await clarity on a potential timing of an US interest rate rise from the Federal Reserve. The tone of the Federal Reserve will be pivotal in which direction Gold moves, and a repeat of the “we will not be in a hurry to raise rates” could lead to Gold shooting back up towards the $1200 region. The longer-term bearish forecasts are still very accurate, however they are also underpinned, and in some ways limited by, when the Federal Reserve actually decides to begin raising interest rates. It’s only when the Federal Reserve begins this cycle that I envisage the long-anticipated decline in metals to occur.

WTI Oil is continuing its downward spiral and I am keeping an extremely close eye on the $42 area. This was where I thought a floor might be located at the time when the price was falling from the high $60’s, and if we do push below here we could be looking at an eventual entry to $35. The bears are definitely re-energized, but I also think that they are exploiting comments from the Federal Reserve Beige Book indicating that it is more concerned about falling oil prices than it was previously. The bears are also looking at reports of the next OPEC meeting scheduled in May/June time to push the price down as low as they can. To be honest, the risk of a dramatic pullback was always strong because the oversupply concerns were never erased in the slightest. US inventories are continuing to be announced far beyond already-high levels and it was reported yesterday that if international sanctions on Iran are lifted, production from the country could reach another one million barrels a day.

The CNY has strengthened to a three-week high against the USD at 6.2428 following Premier Li Keqiang providing the markets with assurances that China policymakers will continue assisting the Chinese economy if economic growth appears at risk to falling below the 7% range set for 2015. Both the CNY and China stocks reacted favorably to the indications that Beijing will be ready to act and protect growth targets. One important factor to point out is that there was a reference to employment in the speech, and it can be suggested that policymakers will be monitoring more closely whether the slowing domestic momentum is providing downside risks to employment prospects.

Written by Jameel Ahmad, Chief Market Analyst at FXTM.

Follow Jameel on Twitter @Jameel_FXTM

For more information please visit: Forex Time

Disclaimer: The content in this article comprises personal opinions and ideas and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime Ltd, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Risk Warning: There is a high level of risk involved with trading leveraged products such as forex and CFDs. You should not risk more than you can afford to lose, it is possible that you may lose more than your initial investment. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved seem unclear to you, please seek independent financial advice.

NOTES TO EDITORS

FXTM is an international forex broker which provides access to the global currency market and offers trading in forex, precious metals, Share CFDs, ETF CFDs and CFDs on Commodity Futures. Trading is available via the MT4 and MT5 platforms with spreads starting from just 0.5 on Standard trading accounts and from 0.1 on ECN trading accounts. Bespoke trading support and services are provided based on each client’s needs and ambitions – from novices, to experienced traders and institutional investors. ForexTime Limited is regulated by the Cyprus Securities and Exchange Commission (CySEC), with licence number 185/12 and FT Global Limited is regulated by the International Financial Services Commission (IFSC) with license numbers IFSC/60/345/TS/14 and IFSC/60/345/APM/14.

The post USDJPY displays resilience while the EURUSD consolidates appeared first on Forex Circles.

Source:: USDJPY displays resilience while the EURUSD consolidates