Yen Advances Amid Middle East Tensions, Trade Worries

The Japanese yen climbed against its major opponents in early European deals on Friday, as worries about rising tensions in the Middle East and persistent trade tensions between the U.S. and China dampened risk sentiment.

The U.S. blamed Iran for the attacks in the Gulf of Oman and said it will defend its forces and interests in the Middle East.

Trade tensions intensified after U.S. President Donald Trump said that he was holding up a trade deal with China and had no interest in moving ahead unless Beijing agrees to four or five “major points” which he did not specify.

Oil prices declined in Asian trading after the U.S. Energy Information Administration cut its forecasts for 2019 world oil demand.

China’s consumer inflation hit a 15-month high in May, but factory gate inflation slowed in May amid sluggish commodity demand and faltering manufacturing activity, reinforcing economic growth worries.

The currency traded mixed against its major counterparts in the Asian session. While it rose against the pound and the franc, it held steady against the greenback and the euro.

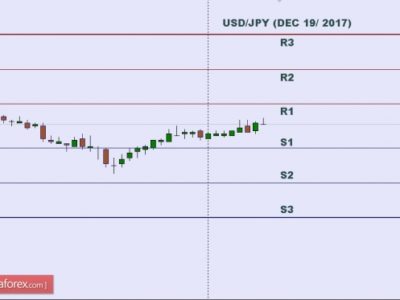

The yen edged higher to a session’s high of 108.16 versus the greenback, from a low of 108.40 hit at 8:45 pm ET. The next possible resistance for the yen is seen around the 106.00 level.

The yen climbed to 8-day highs of 108.72 against the franc and 121.97 against the euro, off its early lows of 109.12 and 122.27, respectively. The yen is seen finding resistance around 107.00 against the franc and 119.00 against the euro.

The yen advanced to a 10-day high of 136.95 versus the pound, following a decline to 137.42 at 6:45 pm ET. If the yen rises further, 134.00 is possibly seen as its next resistance level.

Reversing from its early lows of 81.33 against the loonie, 71.22 against the kiwi and 74.97 against the aussie, the yen firmed to a weekly high of 81.05, 11-day high of 70.70 and a 6-1/2-month high of 74.60, respectively. The yen is poised to find resistance around 78.5 against the loonie, 69.00 against the kiwi and 73.5 against the aussie.

Looking ahead, U.S. retail sales and industrial production for May, business inventories for April and University of Michigan’s preliminary consumer sentiment index for June are set for release in the New York session.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Yen Advances Amid Middle East Tensions, Trade Worries