Fractal analysis of Gold, Silver and Oil on Apr 22, 2020

Forecast for April 22:

Analytical review in H1 scale:

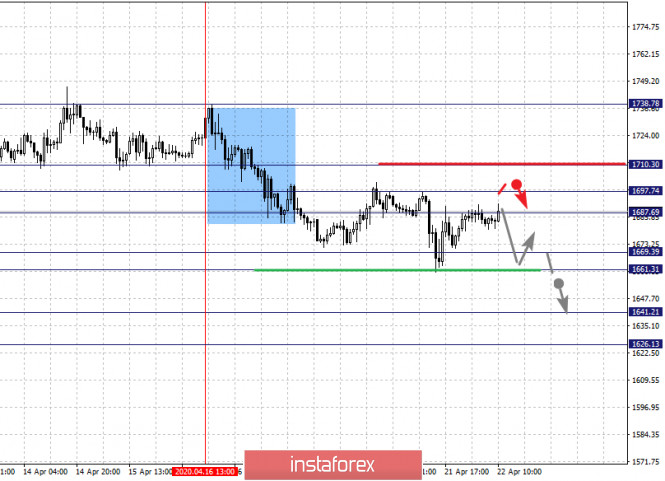

For Gold, the main key levels on the H1 scale are: 1710.30, 1697.74, 1687.69, 1669.39, 1661.31, 1641.21 and 1626.13. Here, we are following the initial conditions for the downward cycle of April 16. The continuation of the downward movement is expected after the price passes the noise range of 1669.39 – 1661.31. In this case, the goal is 1641.21. For the potential value for the bottom, we consider the level 1626.13. Upon reaching which, we expect consolidation, as well as an upward pullback.

A consolidated movement is possible in the range of 1687.69 – 1697.74. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1710.30. This level is a key support for the downward formation.

The main trend is the initial conditions for the downward cycle of April 16.

Trading recommendations:

Buy: 1688.00 Take profit: 1696.00

Buy: 1698.00 Take profit: 1710.00

Sell: 1669.00 Take profit: 1662.00

Sell: 1660.00 Take profit: 1643.00

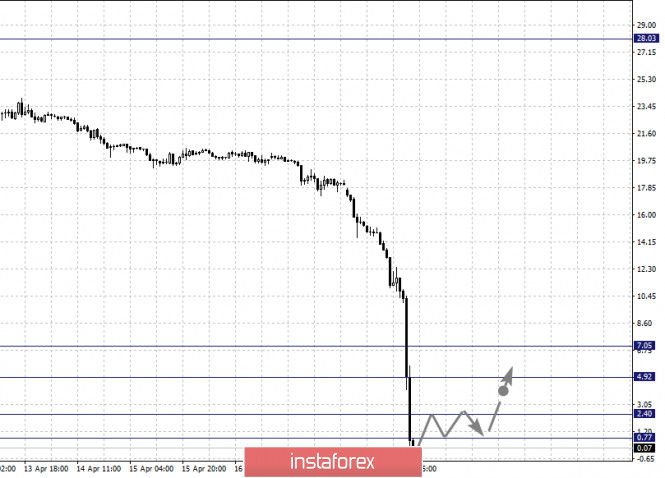

For Oil, the main key levels on the H1 scale are: 7.05, 4.92, 2.40, and 0.77. Here, the price reached the predicted values and the market collapsed. A recovery in the positive price zone is expected. A short-term upward movement is expected in the range between 0.77 – 2.40. The breakdown of the last level will lead to the formation of initial conditions for the upward cycle. Here, the first goal is 4.92. For the potential value for the top, we consider the level of 7.05 and we expect consolidation near this level.

At the moment, the price is near the limit values for the descending structure of April 9, particularly the level 423.6 – 450.00 on the Fibonacci scale.

The main trend is the descending structure of April 9.

Trading recommendations:

Buy: 15.90 Take profit: 17.30

Buy: 17.60 Take profit: 19.80

Sell: 13.60 Take profit: 12.40

Sell: 12.20 Take profit: 10.70

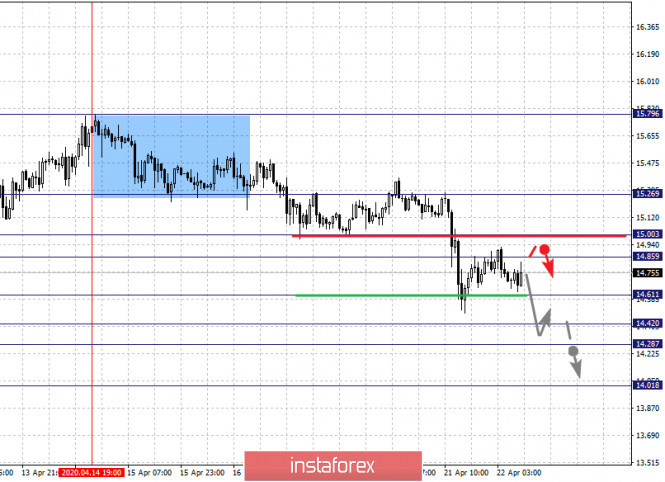

For Silver, the main key levels on the H1 scale are: 15.26, 15.00, 14.85, 14.61, 14.42, 14.28 and 14.01. Here, we are following the descending structure of April 14. The continuation of the downward movement is expected after the breakdown of the level of 14.60. In this case, the target is 14.42. A short-term downward movement, as well as consolidation is in the range of 14.42 – 14.28. For the potential value for the bottom, we consider the level of 14.01. Upon reaching which, we expect an upward pullback.

A short-term upward movement is possible in the range of 14.85 – 15.00. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 15.26. This level is a key support for the downward structure. It is possible to formulate the initial conditions for the upward cycle.

The main trend is the descending structure of April 14.

Trading recommendations:

Buy: 14.85 Take profit: 15.00

Buy: 15.02 Take profit: 15.24

Sell: 14.60 Take profit: 14.44

Sell: 14.26 Take profit: 14.05

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Fractal analysis of Gold, Silver and Oil on April 22