Fundamental Analysis of USD/CAD for June 22, 2018

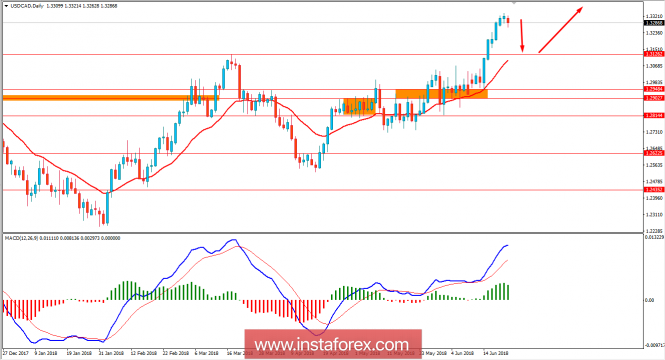

USD/CAD has been quite impulsive with the bullish gains after breaking above 1.3120 area with a daily close recently. USD has been dominating CAD for a few days since the US Fed Rate Hike to 2.00% from the previous value of 1.75%.

After a series of downbeat economic reports yesterday, today US Flash Manufacturing PMI report is going to be published which is expected to decrease to 56.3 from the previous figure of 56.4 and Flash Services PMI report is expected to decrease to 56.4 from the previous figure of 56.8.

On the other hand, today Canada’s CPI report is going to be published which is expected to increase to 0.4% from the previous value of 0.3%, Core Retail Sales is expected to increase to 0.5% from the previous value of -0.2%, and Retail Sales is expected to decrease to 0.0% from the previous value of 0.6%.

As for the current scenario, The pair is set to trade with higher volatility today as several macroeconomic reports are due in Canada. Though USD has been battered recently, any downbeat reading from Canada is expected to lead to further indecision and volatility in the pair. On the other hand, positive economic reports from Canada are expected to push the price lower in the short term.

Now let us look at the technical view. The price depends on the bearish momentum. So,it is expected to retrace towards 1.3120 area before bullish pressure comes back in the coming days. There has not been any bearish divergence in the daily chart right now, but certain hidden divergence effect can be observed that is expected to push the price lower for a while. As the price remains above 1.2900-50 area, the bullish bias is expected to continue further.

The material has been provided by InstaForex Company – www.instaforex.com