Global markets have stabilized. What’s next? (we expect a decrease in USD/CAD pair and a local increase in gold prices)

On Tuesday, the situation in global markets stabilized after the head of the World Health Organization announced with confidence that the Chinese authorities will be able to restrain the spread of coronavirus, which has already claimed the lives of 106 people.

This message was an excellent opportunity to buy back previously actively sold risky assets – shares of companies and assets of the commodity market. Naturally, the demand for gold, government bonds of economically strong countries, as well as the yen and franc, came under pressure on this wave.

However, despite such a positive rollback, we are not yet sure that the news regarding the subject of coronavirus will no longer affect the dynamics of the markets since it is possible that this is just a break before a new decline. Therefore, a lot will depend on the development of the situation as a whole.

Today, the attention of the market will be drawn to the Fed’s final monetary policy decision. We expect that monetary policy parameters will be preserved. The regulator will leave unchanged the key interest rate range of 1.50-1.75% and it will also keep overnight repo and overnight reverse repo at the level of 5 basis points. On the other hand, regarding the commentary by his head, J. Powell, the content of his speech is unlikely to be full of surprises, although he will traditionally report on the existing risks for the world economy against the background of the situation with the Chinese “snake” flu.

We believe that the reaction of the market to the final decision of the Federal Reserve, as well as the speech of its head will be restrained. In turn, investors will gradually turn their attention to the publication of reports of American companies.

As for the dynamics of the currency exchange market, we believe that it will also entirely depend on the situation around the topic of coronavirus, as investors keep it in focus due to the continued high risk of spread, which can have a significant impact on business activity in China and through it world trade.

From the economic data published today, we single out the values of the index of incomplete sales in the real estate market. The indicator is expected to decrease to 0.5% in December from the January value of 1.2%. Also today, data on stocks of oil and petroleum products in the US from the previous week will be published.

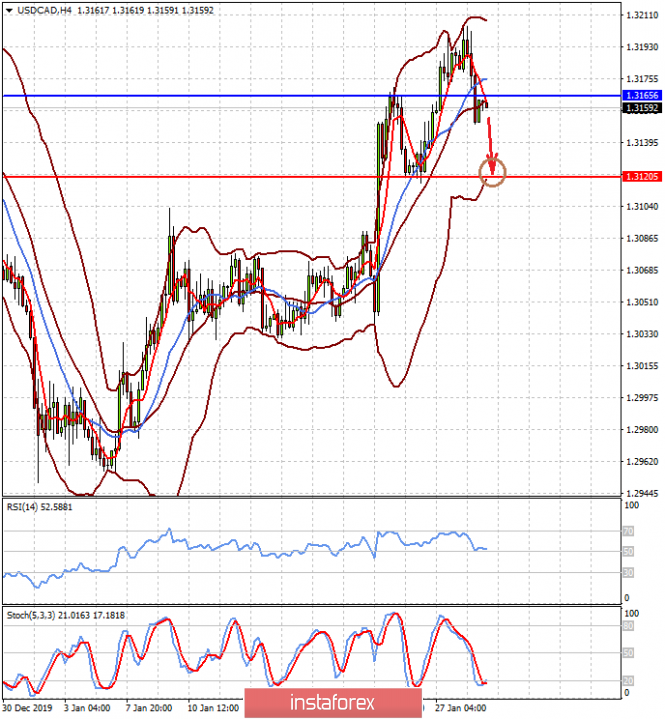

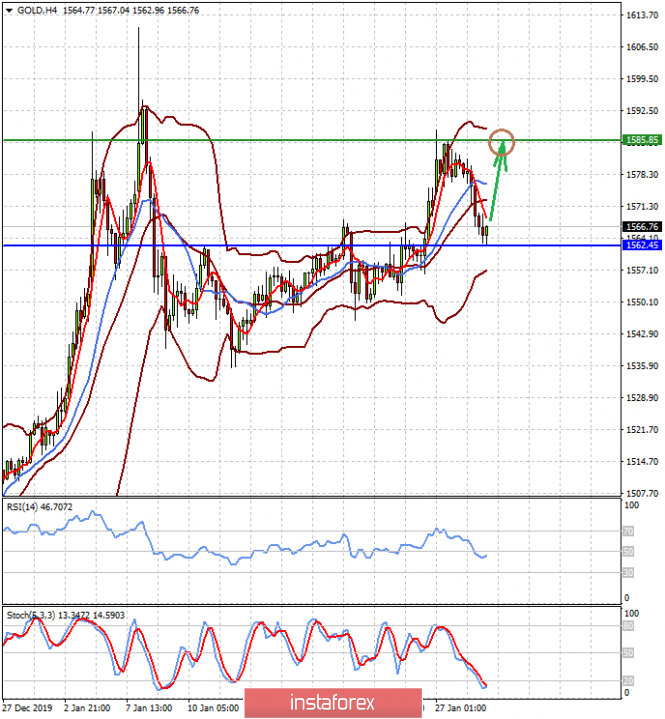

Forecast of the day:

The USD/CAD pair may continue to decline in the wake of stabilization of crude oil prices, as well as maintaining the Fed’s soft monetary rate. At the same time, fixing the price below the level of 1.3165 may lead to a decline in the pair to 1.3120.

Gold on the spot stabilized at the level of 1562.45. The prospective weakness of the dollar, the persistence of tension around the topic of the coronavirus, as well as the Fed’s statement of the continuation of the soft monetary policy may lead to a restoration of demand for gold. This combination of factors can lead to an increase in prices to 1585.85.

The material has been provided by InstaForex Company – www.instaforex.com