USD GDP advances 2.3% in Q1 2018 – Intraday analysis 30-04-2018

Intraday analysis 30-04-2018 – Daily Forex Market Preview

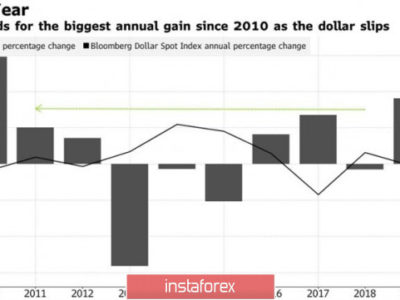

The U.S. dollar remained flat on Friday despite some bullish fundamentals. The U.S. preliminary GDP report beat forecasts to rise 2.3% on the quarter. Economists’ forecast a 2.0% increase during the quarter. Despite the beat on the forecasts, the quarterly GDP was slower than the 2.9% increase seen previously.

Data from the UK disappointed as the UK’s GDP was seen rising just 0.1% in the first three months of the year. The British pound extended losses on the news release.

Looking ahead, the markets get off a busy start. The European trading session will see the release of the German retail sales report. Economists forecast that retail sales rebounded in March, rising 0.8% on the month. This would potentially offset the 0.7% decline seen the month before. Germany’s preliminary inflation report is also due to be released, and the data is expected to show a 0.1% decline in consumer prices following a 0.4% increase.

The NY trading session will see the release of the core PCE price index data. The Fed’s preferred gauge of inflation is forecast to rise 0.2% on the month, rising at the same pace as the month before. Personal spending and income data is expected to rise 0.4%. The U.S. pending home sales report is forecast to rise at a slower pace of 0.6% on the month after a 3.1% increase seen the month before.

EURUSD intra-day analysis

EURUSD (1.2126): The EURUSD was seen attempting to recover from the ECB led declines from Thursday. Price action touched down to the lows of 1.2055 before a modest recovery. The decline to 1.2055 marks a touchdown to the support level and we expect to see a rebound in price in the near term. Resistance at 1.2180 is likely to be the upside target if price action can hold the current support levels. Further gains cannot be ruled out, but the next resistance level is seen at 1.2250. In the near term, we expect EURUSD to hold the range within 1.2180 and 1.2090 – 1.2070 levels.

GBPUSD intra-day analysis

GBPUSD (1.3780): The British pound posted strong losses on the day on Friday following a weaker than expected preliminary GDP report and a stronger than expected GDP data from the United States. The breakout below the 1.3900 level of support pushed the pound sterling lower to test weekly lows of 1.3770, briefly falling below lows from 8th March. In the near term, we expect price action to post a modest recovery. Any gains are likely to be limited to the 1.3900 level where resistance could be established. This is validated by the hidden bullish divergence seen on the 4-hour Stochastics indicator.

XAUUSD intra-day analysis

XAUUSD (1321.59): Gold prices were seen establishing a bottom near the 1316 levels on Friday before price attempted to push higher. The breakout from the descending wedge pattern could trigger a short-term rally to the resistance level of 1325. However, further gains can be expected only on a strong breakout above this resistance level. In such an event, the upside target in gold prices could extend to the 1337 level where the previously breached support level could be tested for resistance. To the downside, a breakdown below the 1316 levels could potentially trigger a sell off to the 1300.00 round number support.

Check out the Orbex Website for more technical and fundamental releases through the day.