Technical analysis of USD/JPY for July 31, 2017

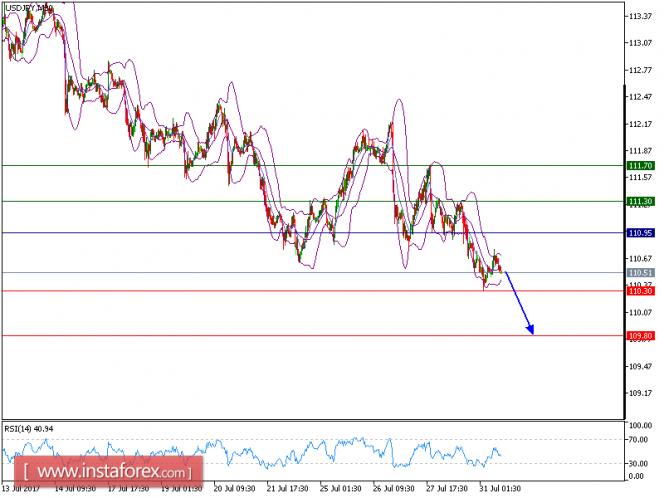

USD/JPY is under pressure. The pair is trading below its 20-period and 50-period moving averages, which play resistance roles and maintain the downside bias. The relative strength index is capped by a bearish trend line since July 25.

Therefore, as long as 110.95 is not surpassed, look for a further drop to 110.30 and even to 109.80 in extension.

Alternatively, if the price moves in the opposite direction, a long position is recommended above 110.95 with a target at 111.70.

Chart Explanation: The black line shows the pivot point. The current price above the pivot point indicates a bullish position while the price below the pivot point is a signal for a short position. The red lines show the support levels and the green line indicates the resistance level. These levels can be used to enter and exit trades.

Strategy: SELL, Stop Loss: 110.95, Take Profit: 110.30

Resistance levels: 111.30, 111.70, and 112.00 Support Levels: 110.30, 109.80, 110.25

The material has been provided by InstaForex Company – www.instaforex.com