Technical analysis of USDX for March 23, 2017

The Dollar index has most probably bottomed and is reversing to the upside. The Dollar index has broken out of the downward sloping wedge and a bounce towards 100-101 is expected over the next two trading sessions.

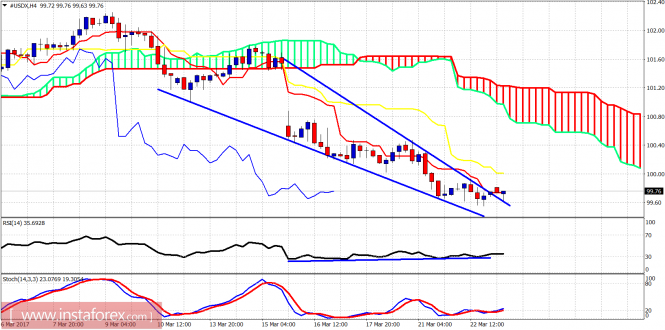

Blue lines – wedge

Short-term support is at 99.25 and at 99.60. Resistance is at 100 and the next is at 100.80-101.There are also bullish divergence signals in the 4-hour chart. This strengthens the scenario of a strong bounce from the current levels.

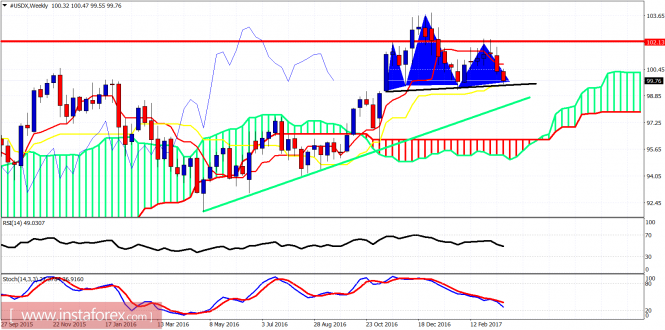

Red line – resistance

Black line – neckline support

Green line – long-term support trend line.

The Dollar index as expected has reached very close to the Head and Shoulders neckline support at 99.25. The price is showing reversal signs. A bounce from current levels will find resistance at 101. Key resistance for the longer-term bullish trend is at 102.30. Support is critical at 99.25. If it is broken, I expect the Dollar index to test the long-term support green trend line.

The material has been provided by InstaForex Company – www.instaforex.com