US GDP raise odds for September rate hike

Updated GDP numbers painted a reassuringly bright picture of the health of the US economy so far this year and raised the odds of the Fed hiking interest rates in September.

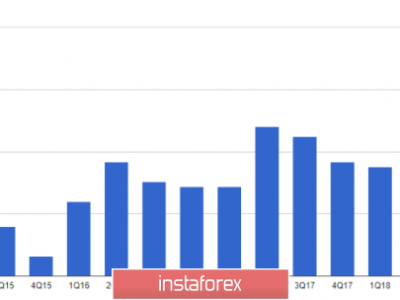

The US economy grew at a robust 2.3% annualized rate in the second quarter, while the 0.2% downturn previously seen at the start of the year was revised to show growth of 0.6%.

The new data, and the first quarter revisions in particular, remove a worrying sense of doubt about the health of the economy that will have given cautious policymakers a reason to hold back on hiking interest rates for the first time since rates were effectively cut to zero at the height of the global financial crisis.

The new data from the Commerce Department were largely as expected (albeit with the second quarter growth down slightly on the consensus of 2.6%), bringing the economy’s growth trajectory in the first half of the year into line with the business surveys, which also indicate that the economy’s strong performance continued into the second half of the year. Markit’s flash PMI surveys, which cover both manufacturing and services, signalled that growth picked up again in July after slowing in June, running at levels consistent with 2% annualized GDP growth. While this suggests the economy may have moved down a gear in the third quarter, it’s a solid enough rate of expansion to reassure policymakers that the headwinds of the strong dollar and uncertainty in the global economy (notably the Greek debt crisis and China’s stock market rout) are not derailing the upturn.

Importantly, the pace of growth is translating into an impressive rate of job creation. The PMI data suggest non-farm payrolls will rise by 225,000 again in July, building on an average 207,000 net monthly gain in the first half of the year and meaning full employment draws ever closer. The jobless rate has already fallen to a seven-year low of 5.3%, down almost a full percentage point over the past year.

The improving job market, alongside the boon to households from low inflation and falling oil prices, has been key to the economy’s ability to sustain strong growth. Second quarter GDP was lifted by a 2.9% annualised increase in consumer spending.

The extent to which the upturn has legs going forward is called into question, however, by a drop in business investment. However, these fears may be overplayed as the decline is likely to have been driven to a large extent by falling capital expenditures in the oil industry, reflecting low oil prices, rather than a pullback in more general investment spending by businesses.

The post US GDP raise odds for September rate hike appeared first on Forex Circles.