USD/JPY set for slide to 105.00, intervention threat increases

Last week, President Trump stated that tariffs of 10% would be imposed on the remaining $30bn of Chinese exports from September 1st.

On Monday, the Chinese central bank (PBOC) fixed the yuan sharply lower and the domestic rate weakened through the key 7.00 level against the US dollar with sharper losses for the offshore rate.

The move increased worries that the Chinese authorities have effectively given up on hopes for a trade deal with the US Administration. Therefore, there will be increased fears over retaliation from China and further limitations on imports US agricultural products.

Risk appetite deteriorated sharply in Asia with US equity futures showing losses of over 1.2% while the 10-year yield declined to 34-month lows below 1.80%. USD/JPY dipped to 7-month below 106.00 and 16-month lows excluding the January flash crash.

China’s move to let the yuan weaken will inevitably antagonise Washington and increase the risk of more aggressive rhetoric from President Trump. There is very little doubt that he will accuse China of currency manipulation and seeking an unfair advantage. It is certainly possible that he will call-off the trade talks entirely.

Trump is also likely to step-up his rhetoric against a strong dollar while unleashing another barrage of criticism against the Federal Reserve.

This is very similar to the Mexican playbook from June where Trump threatened to impose tariffs on all Mexican exports. The move forced Mexico to make concessions with Trump then withdrawing the threat and claiming victory.

US manufacturing and consumer confidence dipped sharply following the threat of Mexican tariffs and business confidence is liable to dip again in the short term, especially if China refuses to engage in dialogue.

Japan’s Finance Ministry has already stepped-up its warnings over recent currency moves and verbal intervention will intensify if the yen continues to strengthen. A weaker yuan will undermine Japan’s competitiveness and damage the export sector.

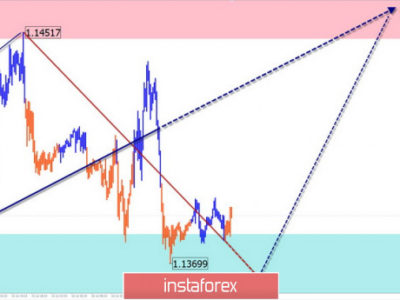

The 105 area will be an initial pain threshold and risks of actual intervention will increase very sharply if USD/JPY slides towards 100.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: USD/JPY set for slide to 105.00, intervention threat increases