What is happening in the commodity market? (gold and silver are at a crossroads)

While the foreign exchange market is unusually dormant in the Christmas week, and the global stock markets made a “cautious” Christmas rally, the commodity market is experiencing a real boom, with almost all the commodity exchange assets and metals in high demand.

Note that throughout December, commodity and commodity markets were feverish. Investors were closely following the topic of Brexit, the US-China talks and, of course, the decisions and plans for the future of the world’s largest central banks on monetary policy. And when it became clear that after the British parliamentary elections, B. Johnson is going to leave the EU in any case, when US and China signed the first stage of trade negotiations, and when the world’s largest central banks announced the continuation of soft monetary policies, “someone, in the Christmas week and at low market volumes, began to actively buy assets of the commodity market almost indiscriminately.

Palladium, which had been falling earlier this week, suddenly turned up. A similar pattern is noted in the quotations of platinum, as well as copper and other industrial metals. Gold and silver came out of a very narrow range and soared, approaching local highs in early November. All this “joy” occurred at relatively low market volumes.

So what could be the reason for this? Perhaps, an unusual rally? In our opinion, the views saying that the unimpressive US economic data and weak dollar have contributed, and is still contributing to the growth of commodity and raw material assets do not reflect reality. The recent and latest economic data from America is not worse nor better than what it was in early December. As for the dollar exchange rate and its dynamics against the basket of major currencies, its weakening is not observed here. The ICE dollar index began to grow actively on December 17, and continues to hold onto its previously achieved positions on Christmas week.

So what seems to be the problem? As we see it, we are faced with a coordinated game against the market on the low holiday volumes of a number of large speculative investors. Such pictures were regularly issued by the Forex market previously. The reasoning that, for example, gold and silver bidders began to actively buy because of the uncertainty of Brexit, is fundamentally wrong. The situation in Britain is not unusual and has been played out before. Another possible reason is the impeachment of D. Trump, which also has no foundation, as there is almost no reality that it will be implemented. The market doesn’t believe it. Another likely reason is the expectation of a slowdown in the growth of the American and Chinese economies this year which is, in our opinion, also does not stand up to criticism because in this case, the price of raw materials would fall: copper, platinum, nickel and other goods. Then, there remains the probability of increased purchases of physical gold, that is indeed underway, however, it is unlikely that it has somehow intensified this week.

And so, we believe that the real reason is precisely a speculative game, which can very likely end with a reversal on the background of large-scale profit-taking and the resumption of falling prices.

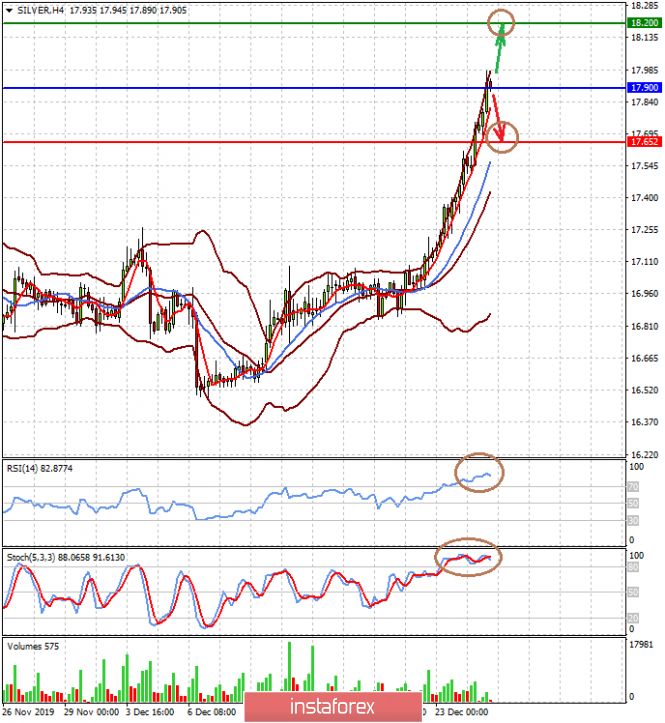

Forecast of the day:

Gold quotes reached a local high in early November and may continue to rise to 1515.60 if they hold above the level of 1500.00. A decrease below this level may lead to the beginning of profit-taking and a price reduction to 1491.00, with a further fall against the background of the official signing of the trade agreement between the US and China.

A similar pattern is observed in the dynamics of silver. We believe that it will react similarly to the changes in the situation, the same as gold quotes. If the price holds above the 17.90 mark, it may still rise to 18.20, but falling below it will lead to a decline to 17.65, and then to a likely return to the 17.00 area.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: What is happening in the commodity market? (gold and silver are at a crossroads)