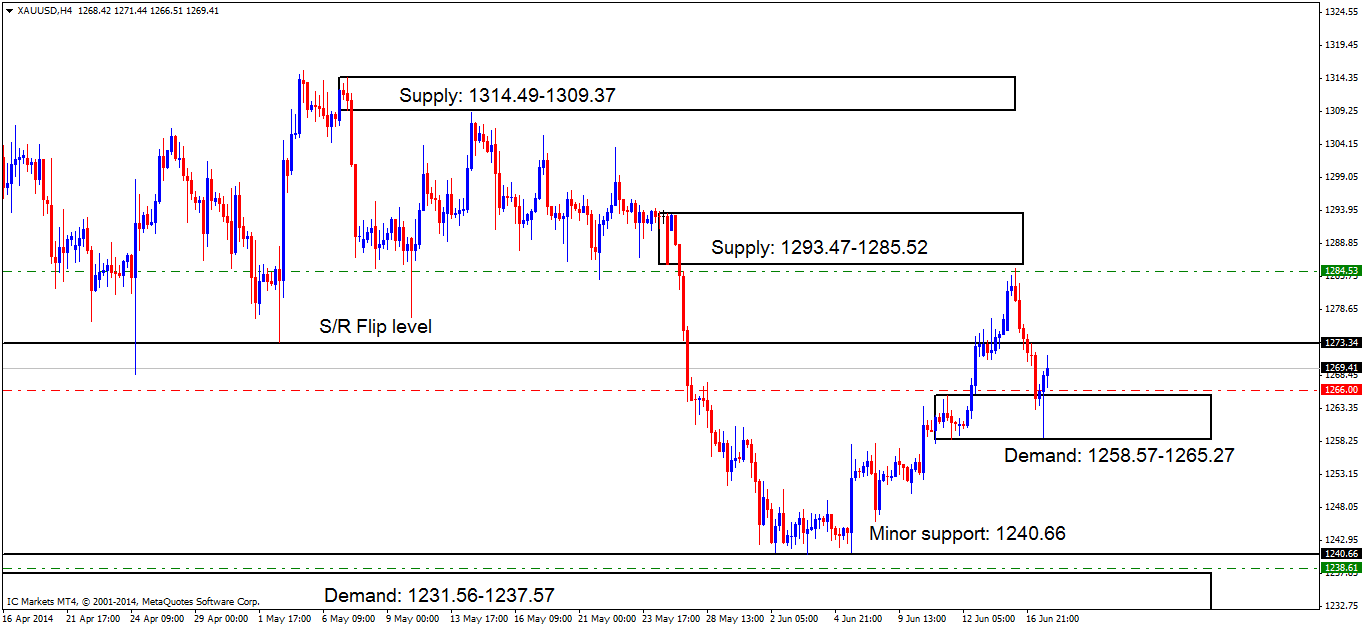

XAUUSD (Gold) Daily Technical Outlook and Review. Wednesday 18th June

The 4hr timeframe shows sellers really took control after hitting supply at 1293.47-1285.52, pushing price down to demand at 1258.57-1265.27 consequently hitting our second target (see below) on our short position up from 1284.53.

Price is currently capped between supply above at 1293.47-1285.52 and demand below at 1258.57-1265.27. A break of either side is possible at the moment as the higher timeframes are not showing much in the way of direction.

- Pending buy orders (Green line) are seen above demand (1231.56-1237.57) at 1238.61 as pro money will in the future likely fake the minor support level at 1240.66 into demand below (levels above).

- The P.A confirmation buy order (Red line) set just above demand (1258.57-1265.27) at 1266.00 is now active. For this level to be confirmed, buyers will need to consume the majority of the sellers around supply above at 1293.47-1285.52, a pending buy order can then be set at 1266.00 awaiting a possible retracement.

- The P.A confirmation buy order (Red line) set just above the S/R flip level (1273.34) at 1273.81 has now been cancelled as price dropped too far from the entry confirmation buy level, and buyers made no attempt to consume the sellers within supply above at 1293.47-1285.52.

- The pending sell order (Green line) set just below supply (1293.47-1285.52) at 1284.53 remains active with price hitting its second target at 1266.00.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

XAUUSD 4hr Chart (click to enlarge)

- Areas to watch for buy orders: P.O: 1238.61 (SL: 1230.64 TP: Dependent on approaching price action after the level has been confirmed) P.A.C: 1266.00 (Active-awaiting confirmation) (SL: likely to be set at 1257.31 TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 1284.53 (Active-2nd target hit) (SL: 1294.70 TP: [1] 1273.34 [2] 1266.00 [3] 1240.66) P.A.C: There are currently no P.A confirmation sell orders seen in the current market environment.

- Most likely scenario: Price will likely meander between where price is currently capped (supply: 1293.47-1285.52 demand: 1258.57-1265.27) during low-volume sessions. A break may be seen when volatility picks up, but at the time of writing it is very difficult to give an accurate prediction as to which level will likely break first.

For the readers’ benefit:

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Source: IC Markets Trading Desk