Control zones for USD/CHF on 08/12/19

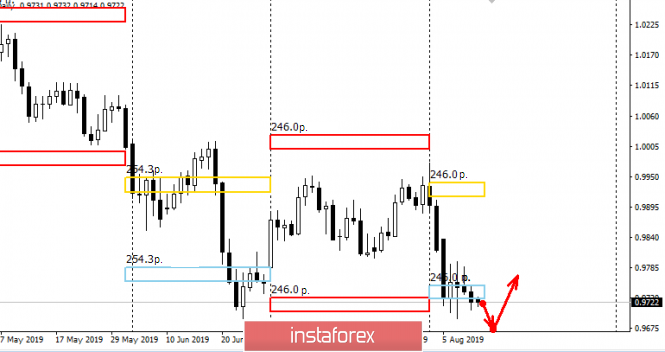

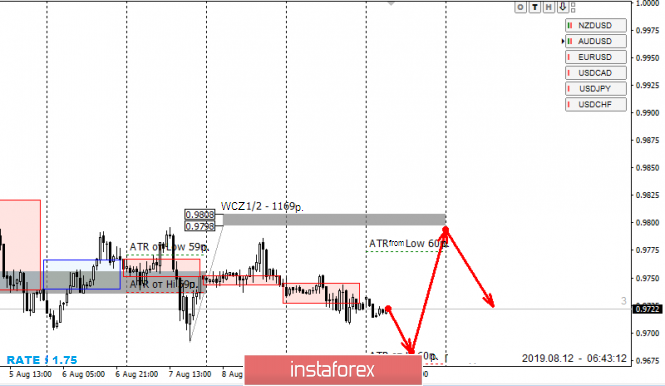

When building daily trading plans, it is necessary to take into account that the pair has already overcome the monthly average move. The emergence of a large demand last week confirms the interest of major players to keep the rate within the formed accumulation zone.

Now, it is necessary to concentrate on the test of the annual minimum formed in June. Reaching this level will allow you to search for a pattern of “false breakdown” to buy the instrument in order to return to the monthly short term. The probability of return is 90%.

The alternative model has a low probability and will be to consolidate below the monthly short-term. Work on the sale is extremely unprofitable, since the probability of making money does not exceed 10%. The most likely model will be a medium-term flat, where the first place will be the search for purchase prices from the lower border.

Daily CZ – day control zone. An area formed by important data from the futures market that changes several times a year.

Weekly CZ – weekly control zone. The zone formed by the important marks of the futures market, which change several times a year.

Monthly CZ – monthly control zone. An area that reflects the average volatility over the past year.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Control zones for USDCHF on 08/12/19