Previous Story

Technical analysis of USD/CHF for August 25, 2017

Posted On 25 Aug 2017

Comment: 0

Overview:

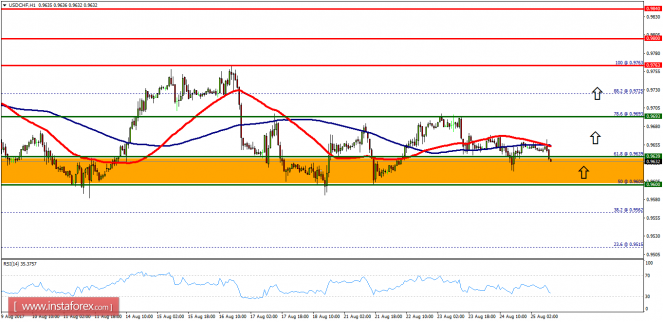

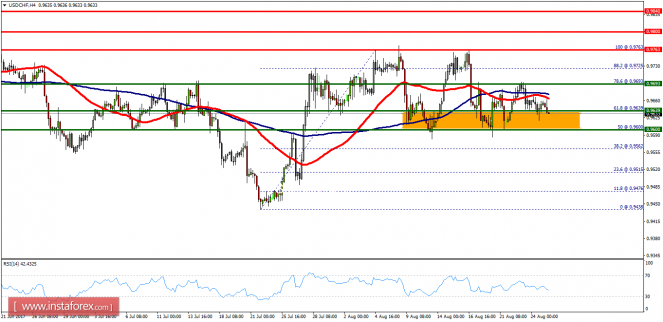

- The USD/CHF pair is still trading upwards from the area of 0.9639/0.9600. The USD/CHF pair didn’t make any significant movements yesterday. There are no changes in our technical outlook. The bias remains bullish in the nearest term testing 0.9693, 0.9763 or 0.9800. The market has been trading around the zone of 0.9639/0.9600. The pair rose from the levels of 0.9639 and 0.9600 (these levels coincide with the ratios of 61.8% Fibonacci retracement and 50%) to a top around 0.9733. The first support level is seen at 0.9639 followed by 0.9600, while daily resistance 1 is seen at 0.9763. The USD/CHF pair is still moving between the levels of 0.9693 and 0.9763 in coming hours. On the one-hour chart, the immediate resistance is seen at 0.9763 which coincides with the double top. Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. The price is still above the moving average (100). Therefore, if the trend is able to break through the first resistance level of 0.9763, we should see the pair climbing towards the second daily resistance at 0.9800 to test it. On the other hand, in case a reversal takes place and the USD/CHF pair breaks through the support level of 0.9600, a further decline to 0.9515 can occur. It would indicate a bearish market.

Observation:

- The trend is still calling for a strong bullish market as long as the trend is still above the level of 0.9600.

The material has been provided by InstaForex Company – www.instaforex.com