Upward Correction for Euro on Hourly

EURUSD 1H

Trading Yesterday:

Tuesday saw the euro update its minimum against the USD and returned to 1.0875 by close. The euro/pound fell to 0.7756. The euro is under pressure due to worries that the ECB could loosen its monetary policy further (reduce interest on deposits or expand QE) at its next meeting.

The dollar was supported on the American session by data from the ISM on business activeness in the industrial sector of the US economy and construction expenditure. Activeness in the US manufacturing sector from Markit saw the opposite with a February fall.

Business activity in the US rose from 48.2 to 49.5. Construction expenditure rose from 0.1% to 1.5%. Markit’s business activeness index fell from 52.4 to 51.3.

Main news of the day (EET):

- 15:15, US employment data for February from the ADP;

- 17:30, US oil reserve data for the week;

- 20:00, Fed Beige Book.

Market Expectations:

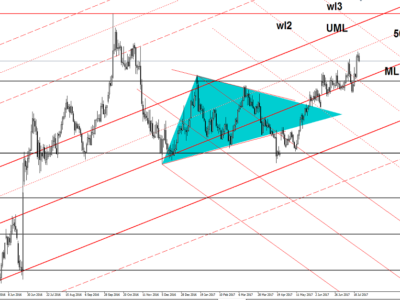

Today there are two things that are worth a look. The first is a UK report on business activeness in the construction sector. The second is a report from ADP (Automatic Data Processing, Inc.). The technical picture on the hourly is showing an upward correction (double bull divergence between the AO indicator and price).

Technical Analysis:

- Intraday target maximum: 1.0895, minimum: 1.0845, close: 1.0865;

- Intraday volatility for last 10 weeks: 103 points (4 figures).

The euro/dollar is trading at the balance line. The fact that the price has restored from 1.0833 to 1.0880 shows that there is a continuation of correctional movement. If the euro/pound cross returns to 0.7825, the euro/dollar will return to 1.0895. Keep an eye on the UK stats.

EURGBP 1H

My expectations for this cross came off in full. Although the lower limit was shifted to 0.7756, the 0.7765-0.7770 support zone held strong. On Tuesday I expect to see a rise in the cross to 0.7820.

Daily

After a break in the trend line on Friday, the euro/dollar fell to 1.0833. On Tuesday a candle with a long shade formed. A bounce on the hourly took place with bull divergence. As soon as the oscillator stochastic flips downside up and the CCI meets the -100 going upwards, the growth of the pair will hasten due to the closure of short positions (partial fixing).

Weekly

I am waiting for the NFP on Friday and the candle of the week to close.

Source:: Upward Correction for Euro on Hourly