USD/JPY Benefits from a Drop in CPI

USD/JPY was able to recapture the 124.00 after dipping to a 123.90 low during the Asian trading session. BoJ sources said that a weak yen is beneficial for the economy, and that the central bank is happy with a declining currency, so long as the pace remains moderate. With the Fed poised to move on rates in either September or December, the dollar should continue to enjoy an advantage of the yen.

Japan’s CPI report, meanwhile, showed very modest June core growth alongside a surprise drop in Tokyo core CPI during July. The contrasting Fed versus BoJ policy paths should keep USD/JPY biased toward a higher exchange rate over the long term.

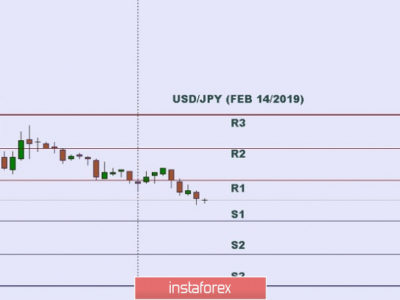

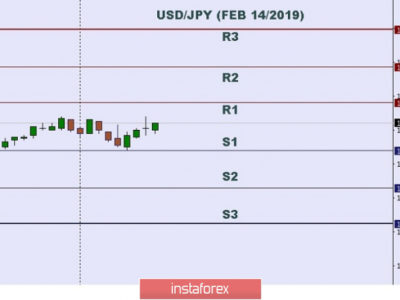

The currency pair was able to hold support level created by a downward sloping trend line that connects the highs in June to the highs in July and comes in near 124.05. Resistance on the currency pair is seen near Thursday’s highs at 124.58. Momentum has turned positive but the trajectory of the MACD is flat reflecting a consolidative tone.

The post USD/JPY Benefits from a Drop in CPI appeared first on Forex Circles.

Source:: USD/JPY Benefits from a Drop in CPI