EUR/USD: plan for the European session on Mar 9, 2020

To open long positions on EURUSD you need:

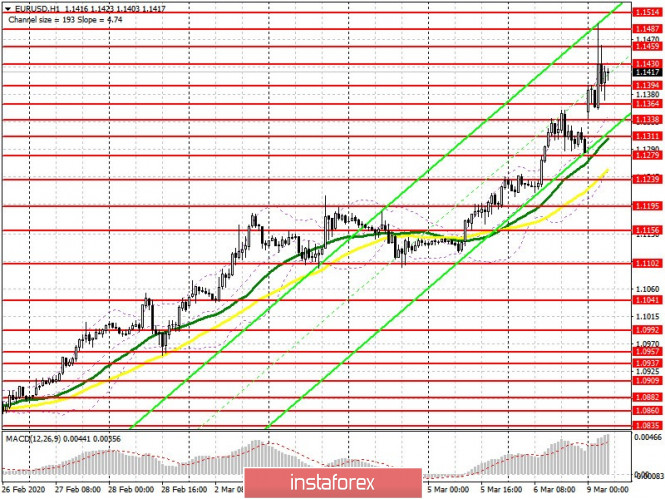

Weak export decline in China and news on the spread of coronavirus in the US and Australia, as well as the closure of nearly all production in northern Italy, led to the collapse of stock market futures and a sharp weakening of the US dollar against the euro. Good fundamental data on the state of the US labor market provided only temporary support to the US currency. At the moment, it is best to consider new long positions in a pair after a correction from the lows 1.1364 and 1.1338, and even better after the support test 1.1311. Given that the euro is seriously overbought, further growth will be only against the background of a worsening global situation with the coronavirus. A break and consolidation above resistance 1.1430 will open a direct road to the area of highs 1.1459 and 1.1487, and also lead to a resistance test 1.1514, where I recommend taking profits in the morning.

To open short positions on EURUSD you need:

I do not recommend selling the euro under current conditions, since no one knows when this panic will end. Given that traders are ignoring the economic calendar, it is best to wait for more detailed sell signals, the first of which will be when a false breakout forms in the resistance area of 1.1459, or slightly higher, near the level of 1.1487. If downward movement does not occur from these ranges, it is best to postpone short positions until the highs of 1.1514 and 1.1539 are updated, however, you can count on them for correction by no more than 20-30 points. It will also be important to return EUR/USD to the support of 1.1394, which will increase the pressure on the pair and lead to an update of the lows of 1.1364 and 1.1338, where I recommend taking profits.

Signals of indicators:

Moving averages

Trading is above 30 and 50 moving averages, which indicates a continuation of the bullish trend.

Bollinger bands

A break of the upper boundary of the indicator in the region of 1.1430 will lead to a new wave of growth in the euro, while the average boundary of the indicator in the region of 1.1338 will act as a support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence – Moving Average Convergence / Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

The material has been provided by InstaForex Company – www.instaforex.com