EUR/USD: plan for the European session on May 28, 2020

To open long positions on EUR/USD, you need:

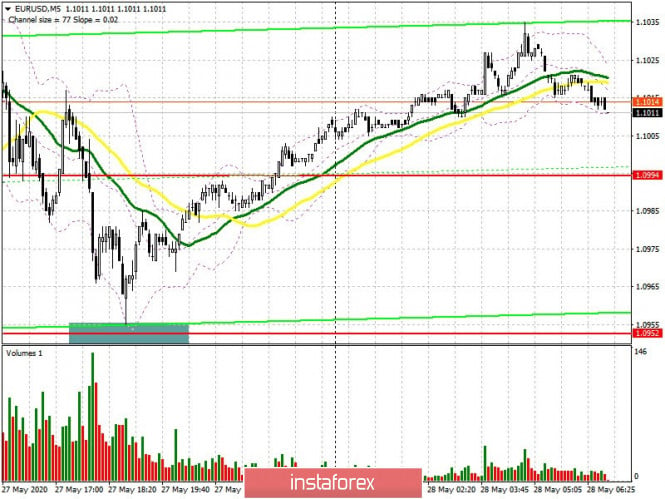

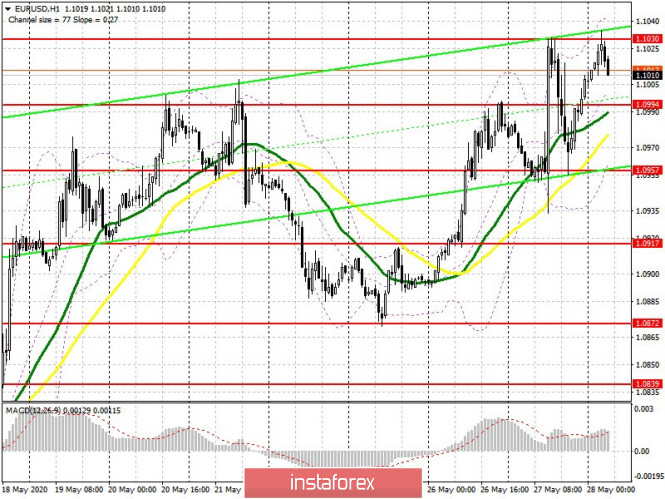

The European Commission said that they plan to allocate EU assistance worth 750 billion euros, which has provided significant support to the European currency. However, the bears tried to turn the market in their direction when the US session was about to open, which caused the euro to quickly fall and test support at 1.0952, from which I advised opening long positions immediately for a rebound in yesterday’s forecast. If you look at the 5-minute chart, you will see how after the breakthrough of support 1.0994 the pressure on the euro intensified, however, the test of 1.0952, which was not reached by just a couple of points, led to a new upward trend, which returned the pair above the 1.1000 area. However, to say that the bulls turned out to be stronger is not entirely true, since Donald Trump is set to announce his decision addressed to China this week, as well as the recent Commitment of Traders (COT) report dated May 19 indicates an increase in short positions, while long positions have partially declined. The report shows an increase in short non-profit positions from 93,840 to 95,194, while long non-profit positions decreased from 171,980 to 167,756. As a result, the positive non-profit net position also decreased and reached 72,562. versus 78,140, which indicates an increase in interest in selling risky assets at current prices. As for the current technical picture of the EURUSD pair, the bulls are aiming for a breakthrough of resistance 1.1030, consolidating on which will definitely lead to a new wave of growth in the region of high of 1.1063 and to the test of larger resistance 1.1093, where I recommend taking profit. Today’s German GDP data in the morning can also confuse all cards, therefore, in case the euro falls, it is best to open long positions after forming a false breakout near the middle of the channel 1.0994, or to buy immediately for a rebound from a low of 1.0957 per 20- 25 points within the day.

To open short positions on EUR/USD, you need:

Sellers failed to keep the pair below 1.0994 yesterday, although the attempts were quite good. Considering that traders only need good news on the next help plan, whether it is accepted or not is not very important for the bull market to continue, today’s focus will shift to returning and consolidating below support 1.0994. This will reduce the ardor of buyers and lead to the return of EUR/USD to the low of 1.0952, and then to the test of larger support 1.0917, where I recommend taking profits. If demand for the euro continues in the morning, and this happens only with good data on German GDP, it is best to consider short positions after forming a false breakout in the resistance area of 1.1030, or sell the euro immediately for a rebound from a high of 1.1063.

Signals of indicators:

Moving averages

Trade is conducted slightly above 30 and 50 moving averages, which indicates a possible continued growth of the euro in the short term.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger bands

A break of the upper border of the indicator in the area of 1.1040 will lead to a new wave of euro growth. The first test of the lower border at 1.0975 may contain the pressure of sellers, but a breakthrough in this area will lead to a sell-off.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence – moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long nonprofit positions represent the total long open position of nonprofit traders.

- Short nonprofit positions represent the total short open position of nonprofit traders.

- The total non-profit net position is the difference between short and long positions of non-profit traders.

The material has been provided by InstaForex Company – www.instaforex.com