EUR/USD: plan for the European session on Oct 21, 2019

To open long positions on EURUSD you need:

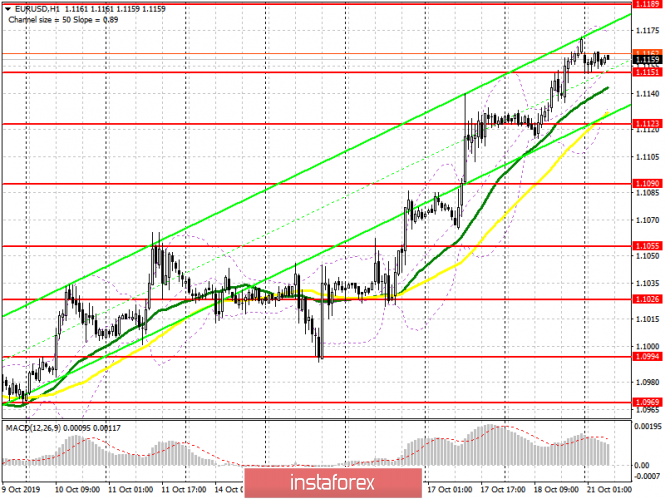

Saturday’s vote on Brexit failed, and the whole emphasis is shifted to today’s attempt. The lack of important fundamental statistics will also maintain low volatility in the market until the voting results appear. To continue the growth of the euro, it is required to keep the level of 1.1151 in the first half of the day, as well as the formation of a false breakout on it, which will update the highs in the areas of 1.1189 and 1.1226, where I recommend taking profits. However, without good news, this is unlikely to succeed. Johnson’s next unsuccessful attempt to advance his deal could put pressure on the pair. Therefore, in the event of a decline to the level of 1.1151 in the first half of the day, you can count on purchases from a low of 1.1123, where the moving average also passes, as well as a rebound from the larger support of 1.1090

To open short positions on EURUSD you need:

The main task of the bears today will be the return of the pair to the support level of 1.1151, which will increase pressure on the euro, and will lead to lows in the areas of 1.1123 and 1.1090, where I recommend profit taking. However, all this can be expected only after the news about the next failure of Boris Johnson, or the failure of the vote on the deal. In the EUR/USD growth scenario, it is necessary to pay attention to the divergence, which is now being formed on the MACD indicator. A test of resistance at 1.1189 with confirmation of divergence will be a clear signal to open short positions. You can sell immediately for a rebound even higher, from a high of 1.1226.

Signals of indicators:

Moving averages

Trade is conducted above 30 and 50 moving averages, which indicates a further increase in the euro.

Bollinger bands

In the event of a euro decline scenario, the lower boundary of the indicator in the area of 1.1135 will provide support. Growth will be limited by the upper level in the area of 1.1175.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20

The material has been provided by InstaForex Company – www.instaforex.com

Source:: EUR/USD: plan for the European session on October 21. Further euro growth will depend on Brexit news