GBP/USD: plan for the European session on Nov 25, 2019

To open long positions on GBP/USD you need:

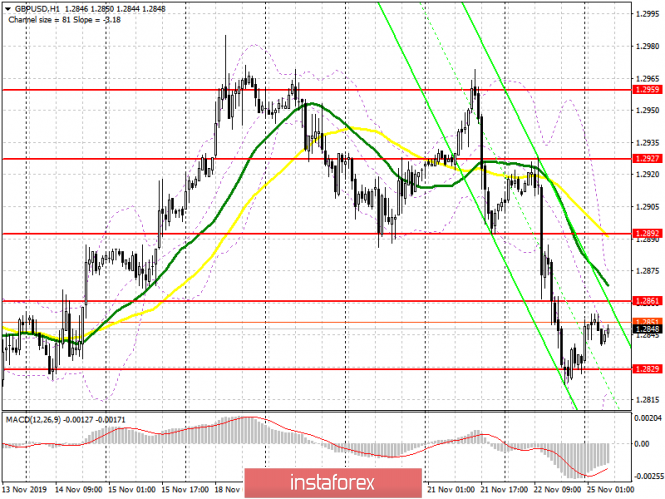

So far, buyers of the British pound aren’t able to keep the pair from a downward correction. The small shift in the situation ahead of the election in favor of the Labour Party put pressure on the British pound, as well as weak data on activity in the service sector. Now, the bulls need to quickly regain the resistance of 1.2861 and gain a foothold on it in the first half of the day, as only this will allow them to build an upward correction in the area of the high of 1.2892, where I recommend profit taking. If the bears continue to act so actively, then it is best to return to buying only if a false breakout is formed in the support area of 1.2829, but it is best to open long positions immediately for a rebound from a low of 1.2800.

To open short positions on GBP/USD you need:

It is enough for sellers not to let the pair move above the resistance of 1.2861 in the first half of the day, and the formation of a false breakout at this level will be a signal to open short positions with a view to further downward movement. However, a more important task for the bears will be to break through and consolidate below the support of 1.2829 at the beginning of the week, which will help maintain momentum and reach fairly important levels of 1.2800 and 1.2769, where I recommend profit taking. No important fundamental data on the UK will be released today so the focus will again be shifted to political games before the elections to be held in December this year.

Signals of indicators:

Moving averages

Trade is conducted below 30 and 50 moving average, which indicates the bearish nature of the market and which act as a kind of resistance levels.

Bollinger bands

Growth will be limited by the upper level of the indicator at 1.2865, while the downward trend will be restrained by the lower level at 1.2820.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence – Moving Average Convergence / Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: GBP/USD: plan for the European session on November 25. The downward momentum could continue