GBP/USD: plan for the European session on Sept 3, 2019

To open long positions on GBP/USD you need:

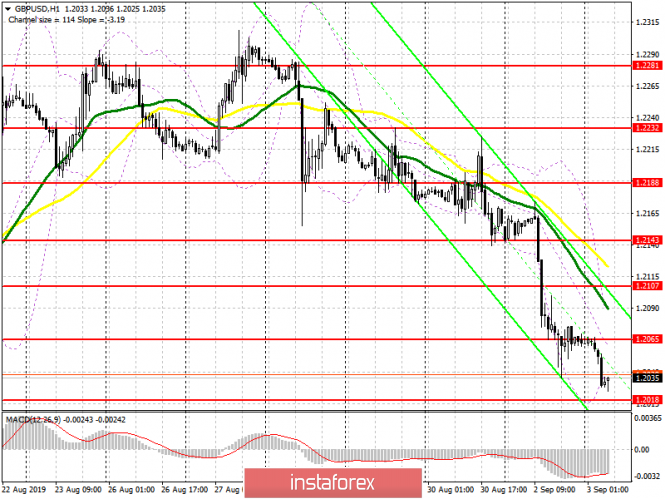

Today, Parliament leaves summer vacations, and the opposition will try to secure the resignation of Prime Minister Boris Johnson, and will try to pass a bill blocking Brexit without a deal. If this cannot be done before Monday, then the probability of Britain leaving the EU without an agreement will increase significantly. Pound buyers are activated at annual lows. To do this, there is support in the area of 1.2019 and the formation of a false breakdown on it will be the first signal to open long positions. Bigger players will defend support at 1.1985, from where you can watch long positions immediately on the rebound. Any success of the opposition can lead to a sharp increase in the pound. The bulls task for today will also be a return to the resistance of 1.2060, which may strengthen the bullish correction and allow to reach a high of 1.2107, where I recommend taking profits.

To open short positions on GBP/USD you need:

The main objective of the pound sellers is to break through the support of 1.2019, around which the main trade is currently underway. Only such a scenario will allow counting on updating the lows of the year in areas of 1.1985 and 1.1949, where I recommend taking profits. Any negative Brexit scenario, and especially today’s parliamentary vote, will further pull down the pound. If the opposition manages to achieve at least something during today’s vote, a sharp rise in the pound to the resistance area of 1.2107 and 1.2143 is not ruled out, from where I recommend opening short positions immediately for a rebound. In the scenario of small growth and the formation of a false breakdown at a resistance of 1.2060, you can also open short positions with a small stop above.

Signals of indicators:

Moving averages

Trading is below 30 and 50 moving averages, which indicates that the pound could continue to fall.

Bollinger bands

If the pound rises, the upside potential will be limited by the upper boundary of the indicator at 1.2100. A breakthrough of the lower border in the region of 1.2020 will increase the pressure on the pair.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20

The material has been provided by InstaForex Company – www.instaforex.com