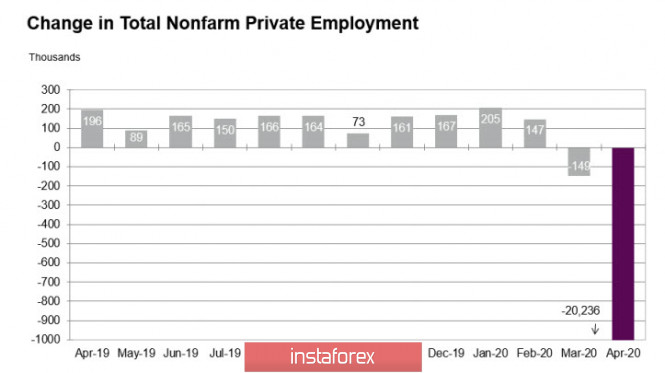

Markets are calm before the publication of the most disastrous report on nonfarm payrolls in history

The ADP report on private sector employment showed an unprecedented drop in private sector jobs by 20.236 million workers, but in general it corresponded to the growth of unemployment applications in the last 5 weeks and did not cause much surprise to the markets. It is already clear that the level of nonfarm payrolls tomorrow will be comparable with the data of ADP, and the markets have already included this drop in the current price level.

Much more attention will be paid to the level of average hourly wages, since this indicator is directly related to a possible increase in pressure on the budget. The lower wages, the higher the threat of deflation, which means the government will need to find reserves for new measures to support falling demand.

On the other hand, Donald Trump has already urged Americans to return to work, even if this leads to an increase in morbidity and an increase in mortality. His statements constitute a clear reinforcement of the argument that the economic damage caused by quarantine measures becomes too great and constitutes a threat to his campaign. While America is calculating the depth of the fall, China is reporting a sharp increase in the trade balance, export growth in April by 3.5%, that is, trying on the role of world economic leader.

Data from China contributed to the positive growth, Brent returned to prices near $ 30 per barrel, European stock indexes were trading in the green zone on Thursday morning. A positive attitude contributes to the growth of demand for risky assets – everyone wants to “catch the bottom”.

EUR/USD

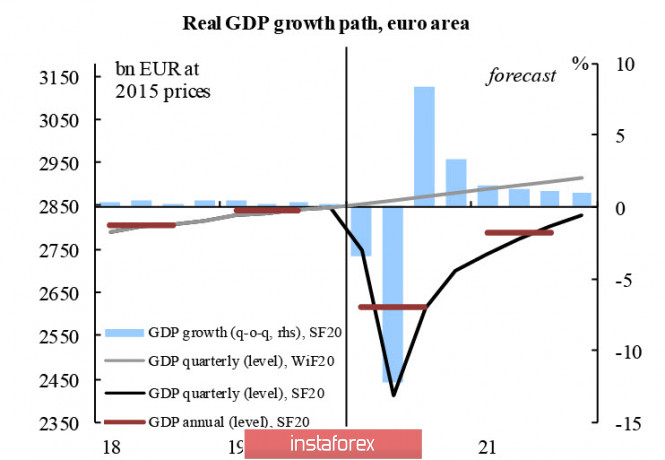

The European Commission published a forecast of economic growth, in which it states that the eurozone GDP will decrease by 7.7% in 2020, but growth will already resume in 2021 and will reach 6.1%. In the US, the EC expects a decline of 6.5%, while it expects an increase of 1% in China. Obviously, as a result of overcoming the crisis, China will not only take the first place in the world in terms of PPP, but also in the total volume of the economy.

In order to justify the reasons for such a deep decline, it is necessary to find the culprit, and it is no coincidence that the vast majority of the 200-page document is devoted to coronavirus. As it turned out, COVID-19 is also the reason for a one and a half year decline in PMI from mid-2017, and a slowdown in industrial production growth rates to negative values since 2018. Moreover, it is most likely that COVID-19 slowed down the growth rate of the foreign trade balance from 2016, lower inflation (and hence consumer demand) since the second half of 2018, and many other indicators.

It is amazing how COVID-19 appeared on time – all the negativity that has accumulated over the years can be attributed to it, like to a war. The collapse of the economy received an understandable and obvious explanation, and now, we can begin to resume growth after the bottom of the fall is found. As a matter of fact, the EC also reports about this, promising GDP growth in 2021 at the level of 6.1% – an unprecedented pace for the weakening eurozone.

EUR/USD is falling in the first week of May, support at 1.0910/40 has not survived, a short-term downward impulse may require correctional growth, but the general trend remains negative. Growth will be limited to 1.0870/90, after which sales may resume. The goal is the support zone 1.0725/65, updating the minimum will change the technical picture to clearly bearish.

GBP/USD

The Bank of England left the monetary policy unchanged following a meeting that ended on Thursday morning. The decision was unanimously supported by all members of the Committee. The asset repurchase program remained at the same level of 645 billion, but the proposal to increase it by 100 billion pounds did not find support.

The decision of BoJ should be considered a bullish factor for the pound, since it fixes noticeably less ambitious measures to support the economy than in the United States, and therefore implies less inflationary pressure in the second half of the year, which will lead to the equalization of the profit spread in favor of the pound. The GBP/USD pair reacted with growth, but the movement is weak and there is not much changed for the pound in the long-term. The pound will remain under pressure and the correction to 1.2520 / 50 will provide an opportunity to sell from a higher level. Therefore, you need to prepare for the breakdown of the support zone 1.2305 / 25 and the movement to 1.2150.

The material has been provided by InstaForex Company – www.instaforex.com