Possibility vs Probability

The sequence of randomness can kill ya

I know this example has been used all over the place to explain this concept of possibility vs probability but honestly, in my opinion, it’s the best and easiest way to explain a basic concept which can get very technical very quickly, so for simplicity sake, will stick to this very common example: Flipping A Coin

Imagine for a second that you are about to play a game in which a coin will be flipped, and you will be required to bet on the outcome of

each flip.

First let’s define the Rules of the game:

- Parameters around HOW the coin can land.

We can assume that a coin has “no memory”. In other words, the coin itself can’t recall or remember on which side it fell the previous 1 or 10 or even 1,000 times, thus for the purposes of this example we will assume that the outcome of every single flip of the coin remains completely random, and without any ties to any prior flips, other than it can only land on either Heads or on Tails (i.e. though the chance of the coin landing upright, standing on its side does exist, the probability of this happening is zero in our example)

- Available capital and size of bets.

You start off with $100 and the rules are very simple, you can bet as much as you want on any one single flip, if you called the flip

correctly your winnings shall equal 100% of the amount you’ve placed on the bet (in other words, if you risked $1 on a flip and you won, then you will be returned $2, being the $1 risked plus the additional $1 won on that particular flip).

Further Analysis

The general laws of probability dictates that for an event with only two possible outcomes, over a large enough sample size (in other words flips in our example), the chances are that each one of the two outcomes shall appear roughly 50% out of all the total outcomes.

The problem in this statement is that it does not necessarily state “50% of the time”.

Let me explain. This small variable describes the difference between probability and possibility. Though it is entirely possible that when you flip the coin 10 times, that it shall land on heads 5 times and tails 5 times, chances are that it will probably not do so every time you flip the coin 10 times.

You see, the sequence of randomness is more pronounced and impactfull across a small number of samples (flips).

As an example:

It is entirely possible (but not probable) that out of 6 flips the coins can land in perfect sequence of heads, then tails, then heads and so on.

But similarly, it remains entirely possible and probable that out of 10 flips heads can show up only 2 out of the 10 times.

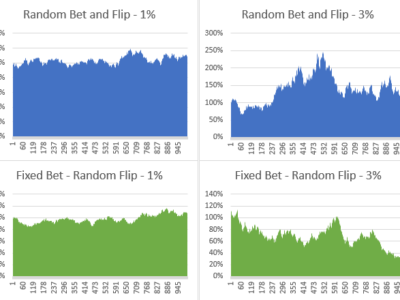

You see, the problem is that unless we find a way in which we can ensure we get to play the game long enough, in other words, to see as many flips as possible, the actual statistics behind the 50-50% probability of this coin-flip game will not have a proper chance to manifest.

In our example above, when the possible outcomes were viewed over a very small sample of 6 flips only, you will agree that this randomness of probability resulted in our flipping-the-coin-game no longer resembling the nice and comfortable risk reward ratio of 50-50%

We therefor need to amend the way in which we approach the game in order for it to return back to the stats.

The only way in which to do that is to find a way that will maximize our ability to stay in the game, in other words, to “survive” as many flips as possible that could possibly go against us.

The “% of Trading Capital” Rule

One of the most commonly used rules, and for good reason, is to not risk more than a predetermined % of your current available capital. Note that we re not talking about trading and not investing, in which case you would invest 1% of your portfolio in a particular asset (also referred to as “equal capital method”). In trading we typically use this rule on an “equal risk” basis, in other words, applying our capital (whatever nominal amount it may be at that time) so that any one particular trade cannot lose more than the equivalent of 1% of your trading capital at any given time.

Why this is important to know is that any trader typically only have a set amount available to trade with, once this runs out – your done! Unless of course you have very deep pockets and can top up your account (which brings with it various other important issues to consider and questions to ask, but that’s for a different topic).

Click Here to learn more about the concept of Maximum % of Trading Capital where I explore what is the most appropriate % level and why.

It is worthy to note that if you consistently risk only 1% of your available trading capital it will take 229 consecutive losers for you to have lost 90% of your portfolio. That is without ever having a winning trade during this time at all!

What I will also teach you is that you will never let yourself go like this…, you will never trade yourself into the ground without allowing yourself the opportunity and ample time for reflection on both your risk parameters as well as your trading strategy.

To prevent this from ever happening we shall also incorporate a concept called “Max Draw Down against High Water Mark”.

Why this is such a benefit to consider is that this will also ensure we gradually progress forward. Imagine how bad you would feel if you started out with and initial portfolio value of $1,000 and traded yourself all the way up to $250,000 only to then lose all that money and end up with a portfolio worth $30,000!

Measured against your initial capital of $1,000 you are still looking great with an amount of $30,000, but overall you’ve allowed your portfolio to deteriorate significantly without ever hitting the big red stop button on the way down.

If you consistently risk only 1% of your trading capital it will take 22 consecutive losing trades before you will hit this 20% Max Draw Down level. Clearly if you had 22 consecutive losers you definitely need a bit of a break from the markets. With a portfolio value now at 80% of original value you still have a manageable chance to trade your way back provided you reassess and adjust your risk and trading strategy pressing the reset button.

The Tale Of Two Returns

In order to explain why we protect ourselves against unlimited draw down of our trading capital consider the following:

Starting with $1,000 and losing 30% implies that you now only have $700 available to trade with. This $700 is your current available capital. In order for you to now trade your way back up to the original $1,000, you would need to make $300 in profit. So to make $300 with $700 capital equates to a required return of 43%!!

Even worse, a loss of 50% on your trading capital implies that on the remaining capital you now have available, you need to achieve a 100% return JUST TO GET BACK TO WHERE YOU STARTED.

So as a FINAL safety net allowing ourselves ample time to reassess, we shall set the drawdown at no more than 20% of the highest level our collective trading capital ever was. This way, if we ever end up losing 20% of our capital, at least our target for the next period is to only make 25% which gets us back to square one, a far more attainable level than the 100% of earlier.

Furthermore, by measuring this draw down level against the highest value of our portfolio it will ensure we protect ourselves, from ourselves, and also limit the damage (as was the case in our example losing value from $250,000 down to $30,000, instead of tapping out at $200,000 being the correct max Drawdown Level).

Taking a Holistic View

So throughout the entire process of our trading we will monitor the following 3 portfolio health indicators closely:

- Max % Risk per single trade

- Max % Risk for all live trades on book at any

one point in time (taking correlation into account). - Constant Monitoring of the Drawdown % measured against the High Water Mark

This will ensure that we allow ourselves, our trading style or system, and most importantly our capital the space and time to experience and be properly exposed to the statistical probability behind our trading methods and thereby aim to ensure our portfolio growth trajectory remains pointed in the right direction!

The post Possibility vs Probability appeared first on My Dad The Trader.

Source:: Possibility vs Probability