Preservation of Trading Capital

Undoubtedly One Of The Most Important Lessons To Learn

Preservation of Capital will have a direct influence over how you are to manage you trading, everything from style, position size, types of securities you choose to trade, all of which has only one single purpose in mind, to keep you in the game for as long as possible.

A State of Mind

Think of it this way, if you go camping for 3 nights and you have 8 match sticks in your match box, one would have a sense of comfort knowing that you should be able to make a fire for each of the 3 nights you intent to spend outdoors. You even have a few matches to spare if something unexpected happens and you can’t start a fire on the first try.

Now, let’s change the dynamics slightly, what if I tell you that you still only have only 8 match sticks, however since you enjoy camping so much, we can stay at the campsite for as long as possible on one condition..

You have to guarantee me that we will have a fire every single night…

Do you agree that this introduction of the unknown amount of time has brought with it a new complication.

It causes you to think differently about your matches doesn’t it? All of a sudden your focus shifts from not having to worry about how to start a fire every night, to “how can I preserve my fire without burning through my matches”. All of a sudden your thoughts go to how to keep your fire from burning out – the longer we can make our matches last, the longer we can stay camping and have fun before returning home.

Isn’t it amazing how just this one factor would change your way of thinking? Its exactly the same when it comes to trading, which I’ll show you later on.

Need to be in it for the long haul

Trading is not a get rich quick scheme. It takes dedication, patience and consistency to be a success. Equally important is the knowledge that experiencing losing trades are part and partial of the process.

Planning on this fact, even better yet, expecting that many of your trades will turn out to be losers is a key component to a winning strategy.

Put differently, if you are in the frame of mind that losing trades are common and part and partial to trading, it will help you on two fronts:

- You wont be hung-up on any one particular trade’s outcome (successful or not)

- You’ll naturally ensure that your losses are kept small as and when they occur

This small, yet key mental shift does wonders for your trading personality. However, as with everything in trading, cannot just be viewed in isolation.

I have found that many retail traders profess to have a thorough understanding of basic Risk Management techniques, yet their main focus is only to guard their capital against any one single, large and unforeseen event.

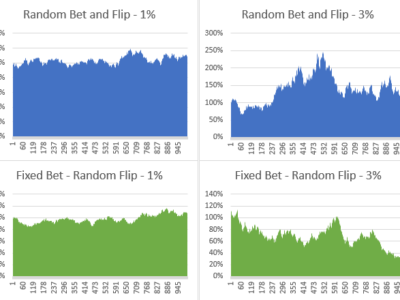

These retail traders often completely overlook the most damaging aspect of them all, consistently losing small amounts without ever putting a stop to the process. They continue to lose small using the argument that as long as I don’t lose more than a certain % on any single trade all will be fine.

Though true in its fundamental form, and a key component that we will always make use of, the % Risk rule cannot be viewed in isolation. If you continue to lose, trade after trade, at some point you will run out of capital.

Draw-Down Limits – The Tool of Professionals

What is a Drawdown Limit? In its most basic form it is a line in the sand that you draw on the maximum loss you are willing to withstand on your trading capital, so that, when triggered, you force yourself to take a break, reassess the situation, correct any obvious flaws in your strategy and dial down trading risk to the bare minimum.

Why is it so vitally important?

If you experience a loss on your trading capital, the direct effect is that you now have less cash to work with in order to trade. The

second obstacle is that from this limited capital base one now have to bag winning trades to an extend that you can recover your lost funds and hopefully return to the original capital amount you’ve started off with.

Consider this though, if your capital is $700, and you want to trade your way back to $1,000 (assuming this was your initial capital) you would require the make 43% from your trading activities. This is quite a big ask, even from professionals! What makes this even scarier is that though you have to make 43%, the initial loss of capital was only 30% (losing $300 from an initial amount of $1,000)

To make it even worse, a drop of 50% In your trading Capital requires 100% return to break-even!!

An increase of 100% on the current Capital only brings you back to where you’ve started from

20% Max Draw Down Limit

In order to give yourself a fighting chance when things goes belly-up, we want to try and limit the max draw down in such a way that if it happens, the return required to get back to square one is not astronomical, and not out of reach given our particular style of trading and risk taking.

I have found that one can work your way up to a 25% return with relative ease (especially when using yield enhancing structures). Keeping in mind that trading is a long-term endeavor, even if you can’t make 25% in one year, you’ll easily manage to recover shortly thereafter.

With this in mind, I recommend a Max Draw Down limit of not more than 20%.

Once you hit this limit, take a break, take a few weeks off from trading to clear your head and analyse your trading up to that point. Try to identify what went wrong. Did your system fail, or did you fail your system — there’s a huge difference between these two!

Trust me, you can’t trade with a negative cloud hanging over your head, so this break is often a much needed tool in the prevention of portfolio self-destruction. Losing 20% requires you to make 25% to get back to your original capital amount and will do wonders for your trading psyche once achieved.

Importance Of Protecting Newly Gained Capital

Professional traders understand the importance of preservation of capital, ALL CAPITAL, not just the amount you started with.

In fact, along with managing one’s emotions, I would say that this point is by far the most important aspect monitored throughout the entire trading process.

The truth remains that you can only trade if you have capital, once that is gone, you’re outa there.

A major benefit of the Max Draw Down rule is that it also ensures that you protect any new growth in your portfolio, in other words,

newly acquired capital.

Trust me, its worth its weight in gold to take a page out of the professional’s trading handbook on this!!

The last thing you want to happen is to start off with $1,000, trade yourself all the way up to $200,000 only to lose all on a down streak ending up with only $50,000 again.

In isolation having turned $1,000 into $50,000 is great, but not when you considered you’ve turned $200,000 into $50,000, losing 75% of the trading capital you had available at one point.

The trick is to bank all your gains and to adjust your Draw Down Limit to an amount representing 20% lower than the highest level your trading capital has ever been up to that point (often referred to as the High Water Mark by professionals)

For this reason, we will always monitor all open positions against the following:

- % of trading capital risked on any single trade

- % of trading capital risked on all open trades

collectively (taking correlation into account) - Measuring the value at risk in line with the Max

Draw Down Limit

It’s a simple rule, be sure to follow it!!

The post Preservation of Trading Capital appeared first on My Dad The Trader.

Source:: Preservation of Trading Capital