Trading plan for EUR/USD and GBP/USD pairs on 07/30/2019

Data on the UK lending market turned out to be very good since consumer lending amounted to 1.1 billion pounds instead of the expected 0.9 billion pounds and 0.9 billion pounds in the previous month. Also, the number of approved mortgage applications, which should have increased from 65,647 to 65,750 but rose to 66,440 instead. Yet, the pound went on steadily anyway, as if without noticing good macroeconomic data. At the same time, the single European currency stood rooted to the spot. In the case of the new British Prime Minister Boris Johnson, who again reminded everyone about Brexit, stating that the United Kingdom will leave the European Union anyway on October 31. If it turns out to sign a divorce agreement suiting the UK by this time, then that’s fine. If not – well, to hell with it. I wish he didn’t say that since everyone perfectly understands the position of the Conservative leader, which boils down to the fact that the UK owes nothing to Europe, (but Europe still as it should) especially in terms of trade preferences for British capital. Also, it is clear that Europe will never do this. Let’s just say, in Europe itself, too many are planning to improve their economies, as well as the labor market, by forcing out British companies and replacing them with their own. Thus, a divorce without an agreement every day becomes more and more realistic scenario. Well, comparing how the parties are preparing for such an exciting adventure, it is not surprising that it is the pound that suffers. Europe has adopted a huge number of regulations and laws that are designed to minimize the consequences of unregulated Brexit. The United Kingdom intends to allocate one billion pounds to eliminate the negative effects. In particular, approximately one hundred million pounds per advertisement campaign to inform Her Majesty’s subjects about how to better behave in this situation. So do not blame those who do not believe in the bright future of the pound and the UK.

Today, the statistics are even worse than yesterday. Although this is not so bad as market participants will have the opportunity in a relaxed atmosphere to prepare for tomorrow’s meeting of the Federal Commission on Open Market Operations. Nevertheless, today’s data on personal income and expenses can be extremely symptomatic. It is expected that revenues will grow by 0.4%, while expenses will rise by 0.3%. By itself, outpacing revenue growth indicates a decline in consumer activity, which negatively affects retail sales and inflation. Well, it already affects the profits of companies. However, such conclusions can be made only if this trend continues for several months. Thus, revenues increased by 0.5% in the previous month and expenses by 0.4%, which is again, the same advanced revenue growth.

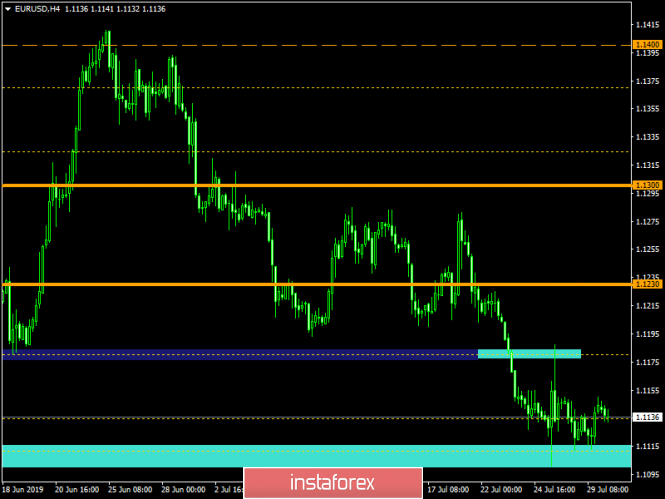

The Euro/Dollar currency formed a range of movement to 1.1110/1.1150 after approaching the key range of 1.1100 and sharply slowed down. It is likely that the current amplitude oscillation will be maintained, where the focus of attention is focused fixing point of the price relative to the existing boundaries.

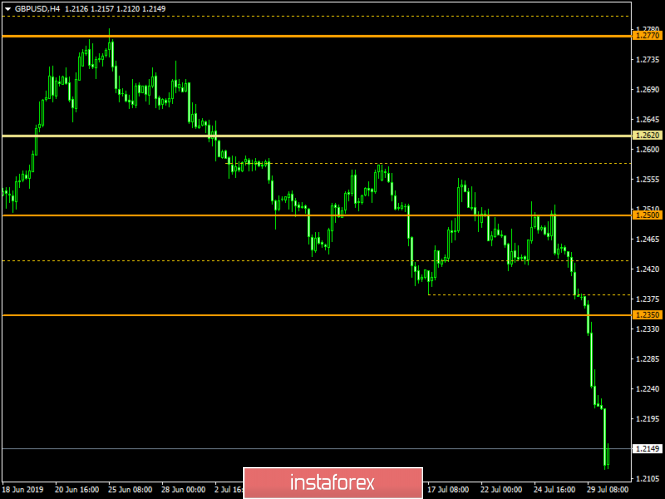

The Pound/Dollar currency pair has shown an active descending interest as it rushed down to the level of 1.2118 while maintaining the inertial move. It is likely to assume that after such a move we have a clear oversold that could result in a rational pullback to the area of 1.2200.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Trading plan for EUR / USD and GBP / USD pairs on 07/30/2019