How To Manage Risks When Trading FX

According to hearsay you have to lose your capital at least three times before you can consider yourself a successful trader. This comes from the fact that people are emotional beings, and that we like to solve our own problems. When a novice trader is just starting out after finishing a course or two on trading, they always remember the great “wall street” wisdom and swear to themselves that they will never do “these kinds of mistakes” in forex trading.

Unfortunately it is not so simple. Fear and greed are two main forces when it comes to trading, and since they are emotions they are well capable of overturning any logical reasoning or thought. This cannot be taught in schools or from books, because you have to experience the thrill of a winning trade and the dreaded feeling of losing your money on a bad trade before you learn to accept and manage them.

Fortunately for us, there are rules and methods to decrease the risk of wiping out your account, and to keep a large enough portfolio to trade another day.

Basic risk management

Say you have decided it’s time to open your first trading account. The deposit has just arrived and you feel you are ready to trade. Instead of firing up the platform to find an entry point you should ask yourself the following questions:

Do I have a strategy? A good strategy is simple, easy to explain, and can be written down. If it cannot be written down to the point where a 10 year old could follow it, then you have most likely “gut feeling” involved, which is a big no-no when it comes to trading.

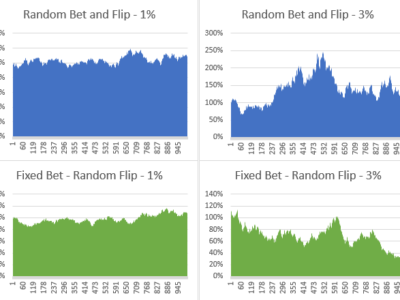

How much of my capital should I risk? Good question, but it depends on your strategy, and on what type of trader you are. If you are a day trader, taking on many positions a day, then you cannot afford to take too much risk with a single position. For one, if it is a losing trade then you have to minimize your losses and limit the impact it might have on your portfolio. Additionally, you will likely open many more positions in a single day, and you cannot allow to keep too much of your capital in one single trade. Even though margin is usually available it does not pay to max yourself out. A recommended exposure to any given trade is 2% of your available funds. If you are trading on a US$ 10,000 account, then you should limit your losses to US$ 200.

The reason for this is simple. You would need 50 losing trades in a row in order to wipe your account clear with the 2% rule. If this is too much, then you can even go as low as 1%. Position sizes play a big part in this. If you trade a standard lot of currency, meaning 100,000 units, then every single point of profit or loss equals $10. A 20 pip movement, and you will be at your stop target.

If your position is only 10,000 however, then it will take 200 points to trigger the stop loss order. A move, which is by no means small and usually there is plenty of time to exit. If you do not over leverage and stick to your stops then you will be around to learn how to pick more winning trades and to limit your losses.

Another great option for managing risk can be done even before you enter into a position. Whenever you feel like placing a trade you have to evaluate and set the stop loss and take profit targets. If you find a good setup which has a moderate risk (say the 2% max loss is way below a major support) but the reward is much higher then you have an optimal setup where the risk/reward ratio is high. You need to consciously look for these kind of setups, because these will be your highest paying trades. An example for this is when the FX pair is at a major, long term support. You can decide to go short or long, but regardless you will be able to anchor your stop and profit levels to this point. A risk/reward ratio of 2 should be the minimum, but preferably even higher. Setups where it is as high as 6 can be found, but are rare.

Some platforms and brokers allow „hedging” orders when forex trading, but this is usually not an option to manage risk. If you have an open long position in a currency pair, and you decide to open another position but from the short side you are essentially closing your original position and locking in your losses or wins. Unfortunately you will most likely have to pay financing charges on both of these positions depending on the underlying instruments. Hedging orders are useful when you want to hedge some sort of exposure, but want to trade regardless and without worry that it might close down your long term strategic position.

Great things will come your way if you take risk management seriously. Most traders fail the test because they want to earn big with a single trade. This depends on pure luck however, and is in no way a consistent strategy. Many accounts have been burned by choosing wrong position sizes or by growing over-confident because they started with a winning streak. Stay low and stay humble, that is key to success if you want to make it big in trading.