EUR/USD: plan for the European session on July 25, 2019

To open long positions on EURUSD, you need:

Today is the day “X”. The further direction of the euro will depend on the decision of the European Central Bank. Almost no one doubts that the ECB will change monetary policy, it remains to understand how much. In the first half of the day, little will change in the market, and a false breakout in the resistance area of 1.1129 can lead to a small upward correction in the euro to the resistance area of 1.1154, where I recommend taking the profit. The breakthrough of this level after the ECB decision will strengthen the demand for EUR/USD and allow the bulls to reach the highs of 1.1183 and 1.1210, but this is only if Draghi leaves everything unchanged. If the downward movement continues, it is best to return to long positions after updating the monthly lows in the area of 1.1105 or to rebound from the level of 1.1079.

To open short positions on EURUSD, you need:

Bears will be waiting for comments from Mario Draghi and expect a breakthrough of the support of 1.1129. Most likely, the data for Germany, which will be released in the morning, will be ignored by the market. Fixing below the level of 1.129 will only give a new impetus to the downward trend, which will lead to new lows in the area of 1.1105 and 1.1079, where I recommend taking the profits. If Draghi is sufficiently restrained in his statements, the bulls can take advantage of this moment and break above the level of 1.1154. By the way, a false breakout of this level in the morning is a signal to sell the euro. If EUR/USD gets above the level of 1.1154, it is best to return to short positions on the rebound from the maximum of 1.1183 or 1.1210.

Indicator signals:

Moving Averages

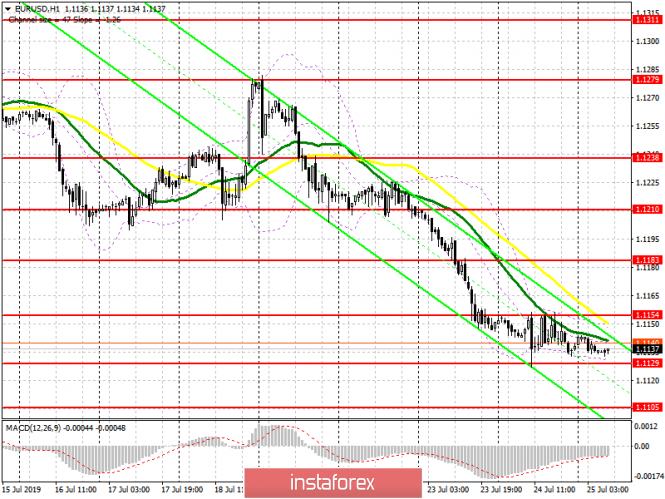

Trading is below 30 and 50 moving averages, which indicates an advantage on the part of euro sellers.

Bollinger Bands

Volatility is falling, which does not give signals to enter the market before important data.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

The material has been provided by InstaForex Company – www.instaforex.com