EUR/USD: plan for the European session on Sept 19, 2019

To open long positions on EURUSD you need:

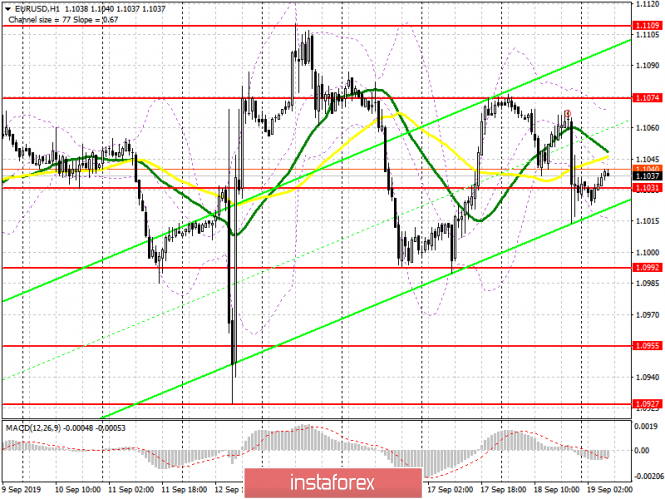

Yesterday, a decision was made to lower the key interest rate in the US to 2.00%, however, such a decision was already taken into account by the market, which did not lead to a sharp surge in volatility, since the Federal Reserve did not talk about further changes in monetary policy. Nothing has changed at all from a technical point of view. Buyers still need to break above the resistance of 1.1074, which will lead to the euro’s continued growth to the area of a high of 1.1110, as well as to update a larger resistance level of 1.1151, where I recommend taking profits. If the pressure on the euro returns in the morning, then it is best to consider new purchases after updating support at 1.1031, with the condition of the next formation of a false breakdown there, or a rebound from a larger low in the region of 1.0992.

To open short positions on EURUSD you need:

Sellers will wait for a breakout of support at 1.1031, which will increase the pressure on the pair and will lead to a further decline to the area of larger lows at 1.0992 and 1.0955, where I recommend taking profits. In case the pair grows in the first half of the day to the resistance area of 1.1074, one can look at short positions there only on a false breakdown. You can immediately sell EUR/USD for a rebound from last week’s high in the region of 1.1110. Given that there are very few fundamental reasons for the euro’s growth, amid the gradual pullback of the economy into recession, the bears will try to return the market to their side in the near future.

Signals of indicators:

Moving averages

Trade is conducted in the region of 30 and 50 moving averages, which indicates market uncertainty.

Bollinger bands

A break of the lower boundary of the indicator at 1.1015 will increase pressure on the euro, while the upper boundary at 1.1068 will limit the upward potential in the morning.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20

The material has been provided by InstaForex Company – www.instaforex.com