GBP/USD: plan for the US session on Mar 23, 2020

To open long positions on GBPUSD, you need:

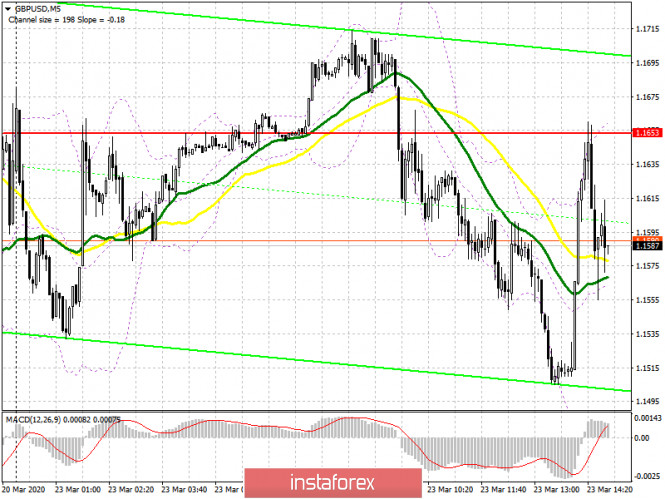

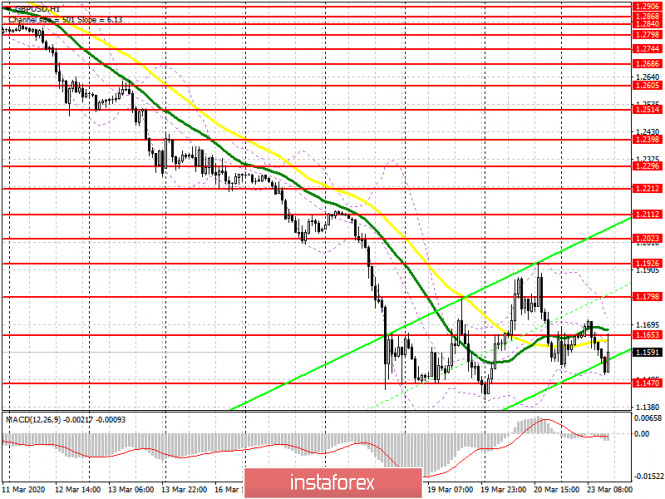

News that the Federal Reserve is ready to provide loans to anyone who needs it in unlimited quantities only momentarily weakened the position of the US dollar, which continues to enjoy demand against the backdrop of the growing crisis. On the 5-minute chart, you can clearly see how the bears return to the level of 1.1653, and after updating it from the bottom up, they arrange another sale, which was interrupted by the Fed’s statements. At the moment, the bulls will try to regain this range, which will push the pair higher, to the resistance of 1.1798, and then to the larger level of 1.1926, where I recommend fixing the profits. If the pressure on the pound continues, it is best to return to long positions only after a false breakout in the area of 1.1470, or a rebound from round figures in the area of 1.1400 and 1.1300.

To open short positions on GBPUSD, you need:

No news on the UK economy or Brexit is able to return optimism to the market. And what kind of negotiations can there be if the chief negotiator, Jean-Claude Juncker, has become infected with the coronavirus, and the decrease in the UK’s GDP in the second quarter may amount to more than 5.0%. At the moment, the bears’ task will be to protect the resistance of 1.1653, where the formation of a false breakout will be the next signal to open positions. The sellers’ goal will be the minimum of this year, the breakdown of which will lead to a further sale of GBP/USD in the area of 1.1400 and 1.1300, where I recommend fixing the profits. In the scenario of growth of the pair above the resistance of 1.1653, I recommend postponing short positions until the update of the larger highs of 1.1798 and 1.1926, where you can sell immediately on the rebound.

Signals of indicators:

Moving averages

Trading is conducted below the 30 and 50 daily averages, which indicates the continuation of the bear market, but to resume the trend, a breakthrough of the annual lows is required.

Bollinger Bands

In the case of an upward correction, the upper limit of the indicator in the area of 1.1730 will act as a resistance. In the scenario of a decline in the pound in the second half of the day, the lower border of the indicator around 1.1480 will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence – moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

The material has been provided by InstaForex Company – www.instaforex.com