How to Start Your Own Forex Trading Enterprise

It is an accurate statement of the fact that the forex market generates more than $5 trillion in trading volume every single day. There is definitely money to be made in forex; this has created a lot of activity in the sector for those who have an eye for making cool money. But then, many traders have lost out on their investment in this tricky and highly volatile sector of the economy.

On the other side of the divide, traders are making a fortune out of the market with the tick of the second every day. So, how best can you profit from the market? The following tips will surely be of valuable help in your bid to get your consolidated credit from the sector.

Learn the basics of currency trading:

The first thing that you are expected to do is to take your time to learn the basics of the trade. The problem with most traders is greed. There is no magic about happenings in the sector, and this is not a magical way of getting money; do not be tempted by the huge trading figures but rather focus on getting to learn the tricks. You have to start small if you want to avoid telling the stories that touch the heart.

Choose your broker carefully

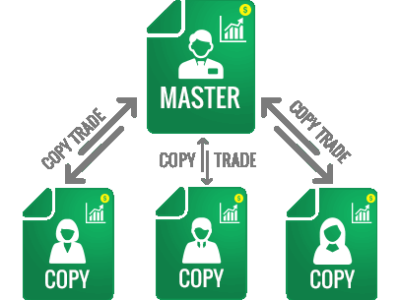

The Broker of your choice will either make or mar you. There are several brokers online who are only after what they are going to get from you and are less concerned about your progress. If you trust any of them that you will get to see online, make sure that you are dealing with the particular broker that has a reputation that you can count on before entering into any deal.

Liquidity:

In your attempt to establish your own brokerage, you must understand the concept of liquidity. The 2008 financial crisis made many small and medium prime brokers to lose their accounts. You will receive cover from the concept of the Prime of Prime which has been saddled with the role of helping small brokers get their benefits from the Prime Brokers.

Pick your account type, and leverage ratio in accordance with your needs

If you are new to this industry, it is strongly advised that you start with a mini account and take your time to learn through the ropes. If you have some experience, then you are advised to opt for that account that is most suited for your knowledge level to be on the safe side. If you have an understanding of leverage and general trading, your best option will be a standard account.

Focus on a single currency pair:

The terrain of the market is chaotic, if you desire the best out of your consolidated credit, and because there are diverse trading options that will end up making people without a particular focus confused, you are strongly advised to keep your focus on a single currency pair if you really want to sustain the gains practically.

Begin with small sums

The problem with many traders is their greed for quick wealth. If you want to maintain the gains here, then you have to forget about the big figures and begin small. It is recommended that you start with the $30 free trading bonus. Try the 7 Asset Classes – 16 Trading Platforms. You can trade over trade over 1000 Instruments. When you begin small, you will learn the ropes and move slowly but steadily to hit the top in the market.

Increase the size of your account through the organic gain:

When you start making the gains, do not make the mistake of pillowing everything back into the volatile market because you want to hit the jackpot. Rather, you are advised to take it rather slowly. Look at the margin of your organic gain from the trade and use it to increase the size of your trade and is still happening to people today. Rather, you will have something to fall back to is all does not go well with you in the market.

It is slow and steady, as you build up your margin gain, use that to increase the size of your trade and in the event that you lose in the trading, you will not end up losing out completely as it had happened

Understand that forex is about probabilities:

Finally, you have to get this straight that there is a full proof strategy in the forex market. It is all a game of chance and probability. This is purely about risk analysis, and you will not win all the time. This chance event might make you hit the jackpot this minute; the next minute, the same strategy might see you on the losing end of the divide that is pure truth.

Therefore, you have to take control of your emotions. When you win, do not be overly excited because it may be the turn for the worse in your next click of the mouse. You have to develop a thick skin and expect the worst at any time along the line of trading. If you get to put your emotions under control, then, you are sure going to be happy when you win; your countenance will remain the same in the event that the trading does not go your way. That way, you are a winner all the times in this game of consolidated credit where this moment you are a winner; the next moment you will be made to swallow the bitter pill of defeat.