Preview -Your Visual Guide To Trading The Nonfarm Payrolls

There has been lots of tradable news this week with more to come. However the markets are clearly waiting for NFP, the most closely watched figure each month.

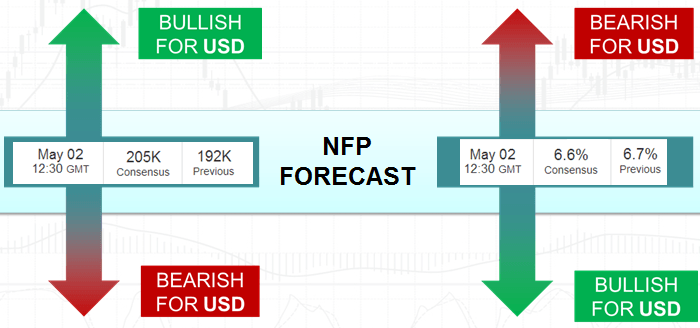

With tomorrow’s consensus at 205k jobs created, this is the highest forecast since March 2012. If this comes in or above target we will see NFP at a 5-month high (unless it comes above 268k which would make it the highest since Feb 2012).

With ADP employment change yesterday at +220k and above consensus, with initial Jobless claims later today also forecast to be low, the markets are expecting a good NFP number tomorrow.

Whilst this data is usually USD bullish it is interesting to see that the USD Index (DXY) produced a bearish engulfing candle yesterday below 80 resistance following mixed data from the US yesterday. If we continue to hover around the weekly lows then we can assume that positive jobs data is not priced in and leave more ‘meat on the bone’ for USD bulls in the event of good numbers tomorrow.

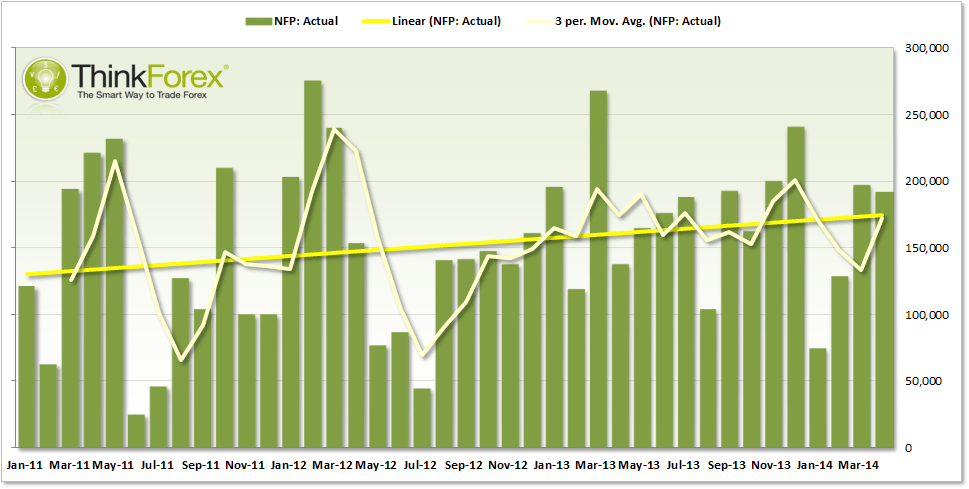

NFP has been positive since Jan 2011 and overall, whilst a volatile release, is trending up. The past 2 releases have also been above its’ own 3-period MA.

By looking at this raw data we can more easily quantify a meaningful move from a ‘flash in the pan’. The frequency chart shows the differential between expected and consensus, with a positive number denoting above expectations and below falling short. Typically we come in +/- 40k around 48% of the time, so I am looking for differentials between +/- 60k for any sustained effects on the markets.

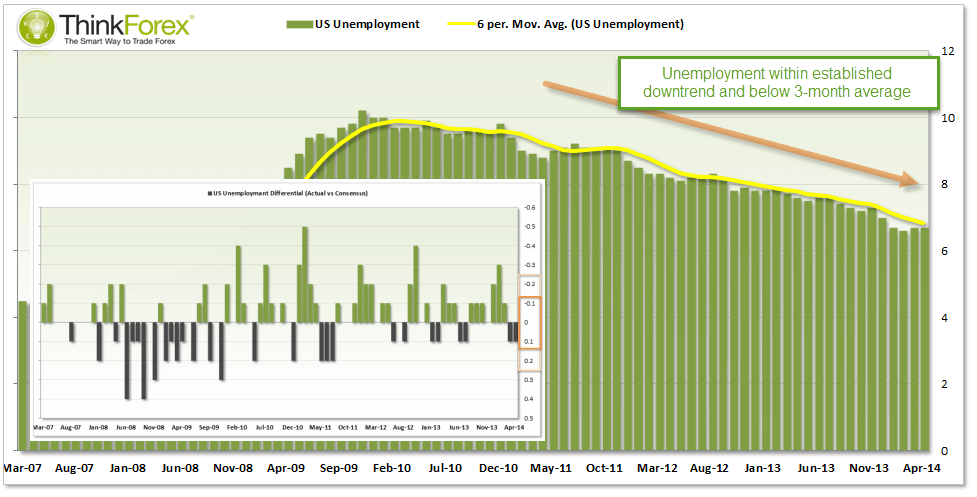

The differential between expected and consensus (inset) tends to be 0.1 out, so whilst unemployment of 6.7% or 6.5% will move the markets the effects should be limited, as the markets look at other data for a clearer picture.

Where do you think the jobs number will come in at? Let us know your strategy and thoughts in the comments section below.

A version of this article was first published on ThinkMarkets