So You Need Proof of Market Correlation? Here it is…

Often times when I speak with traders I hear a recurring theme: “I trade what I see”. Traders with this approach are saying that they don’t believe in, or value, fundamental analysis as a mechanism to interpret market conditions and potential opportunities. They only look at technical analysis or price action as a basis for their trading systems. First and foremost I would have to agree: you should trade what you see; but to ignore fundamental analysis altogether is clearly omitting a tool from your trading arsenal and with many different ways to use and interpret fundamental analysis it makes sense to be open minded to the possibilities.

At Market Tea Leaves we teach fundamental analysis as it relates to futures with the concept that all markets are related. For those of you who trade Forex this should come as no surprise as there has long been the idea of “correlated pairs”. Whereas the idea of correlated pairs is a universal truth, the core idea that we teach is Market Correlation, which is to say that the markets themselves are correlated.

Historical Fundamental Tainting

The perceived value of using fundamental Analysis has taken a significant hit during the last 10-15 years through events such as the Enron and MCI scandals, causing traders and investors to question the validity of putting trust in something that was not as it appeared. Up until that time “the fundamentals” were considered a cornerstone of anyone’s trading strategy.

As with all major market scandals, reform saw the implementation of new laws including the “Chinese Wall” that ended up serving as a divide be between the fundamentals and technical analysis. After the scandals the markets rebounded and continued to go to higher highs and the prevailing thought was that “we don’t need to be concerned about the technicals”. The mindset was that markets will always rebound. Even during the summer of 2002 and after 9/11 it was thought that the markets would experience a u or v shaped recovery. When this didn’t happen the wind was once again out of the sails for the fundamentals.

Market Tea Leaves

I teach market correlation with the intent of providing a trader with a sense of direction for the markets that day. I don’t determine which fx pair, stocks or futures to buy or sell, I don’t make calls on entry or exits. I do provide a bias for that day: upside, downside or neutral. Note: a neutral bias means the markets could go in any direction that day.

Each day in Market Tea Leaves I provide my subscribers with charts of both the USD and Swiss Franc. These charts show reverse correlation between the USD and the Swiss Franc.

Example

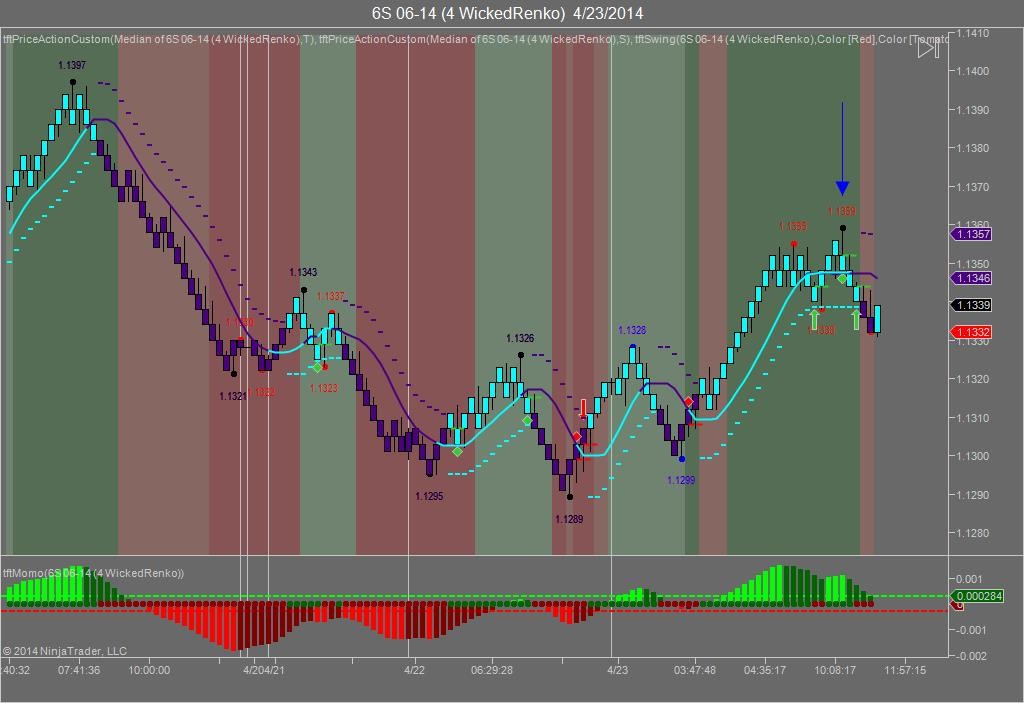

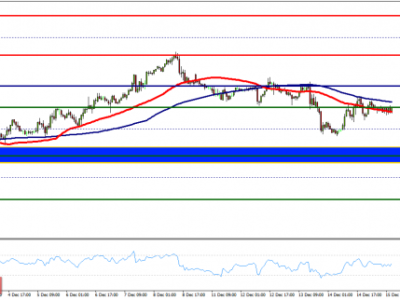

The charts below show a clear example of correlation between the USD/CHF pair, this type of market correlation occurs on a frequent basis. The first chart is the Swiss Franc on Thursday, 4/23/14. It highlights a shorting opportunity (at the blue arrow) on the Swiss Franc at about 10:20 AM EST. Please note these charts are 4-tick renko charts on NinjaTrader, built with a Third Party add-on called Trend Following Trades.

Swiss Franc 4/23/14 (click to enlarge)

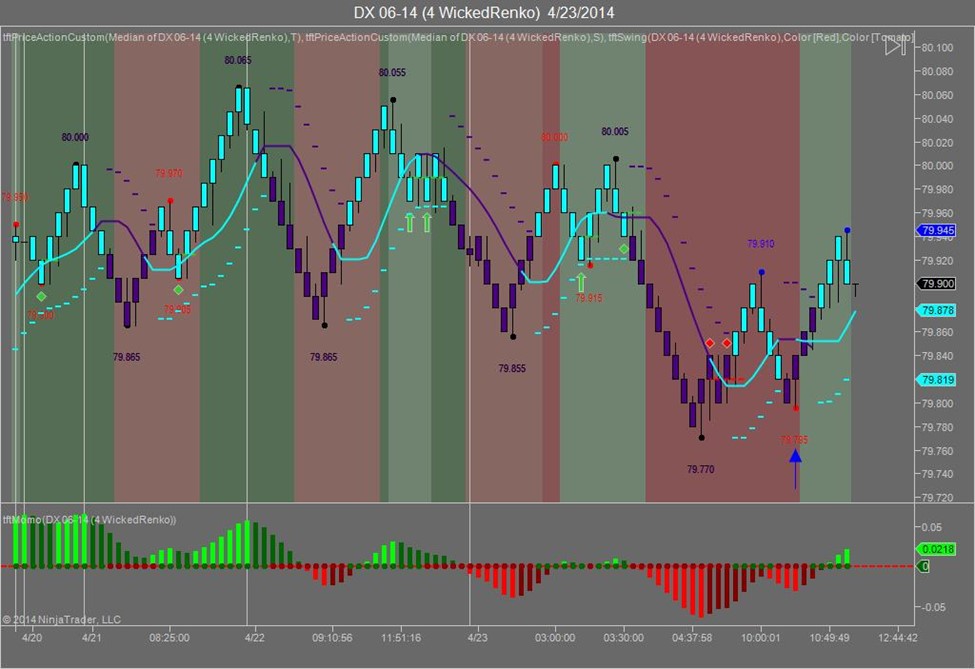

This following chart shows the USD at approximately the same time.

USD 4/23/14 (click to enlarge)

Notice that as the USD rose, the Swiss Franc fell thereby creating a shorting opportunity on the Swiss Franc. We show this correlation each and every day on Market Tea Leaves. So in answer to the question at hand, yes the markets are correlated and to learn more feel free to visit www.markettealeaves.com

What are your thoughts on market correlation? Share your views in the comments section below.