GBP/USD: plan for the European session on Nov 21, 2019

To open long positions on GBP/USD you need:

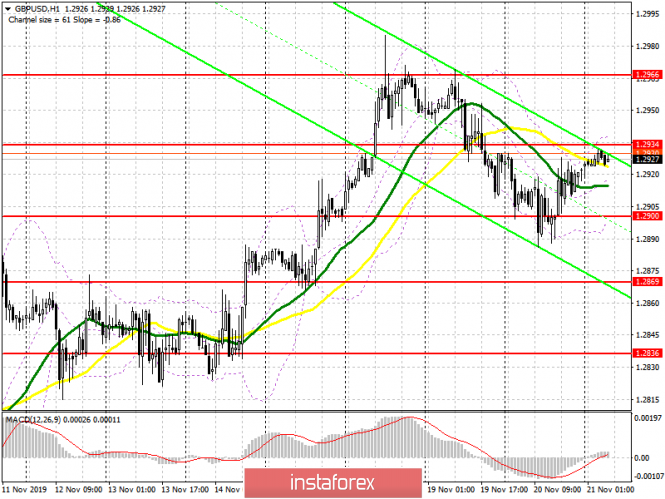

The lack of important fundamental statistics and news on the general election in the UK did not allow the pound to continue the downward correction, and the unsuccessful breakout of the support of 1.2900 caused the pair to return to the resistance area of 1.2934, where the main trade is currently being conducted. Buyers will focus on this level of resistance, a breakthrough of which will allow us to talk about the bulls’ return to the market and the continuation of the upward trend to the highs of 1.2966 and 1.3017, where I recommend profit taking Given that no important fundamental statistics are planned for today, we can expect the GBP/USD to further fall to the support area of 1.2900, from where I recommend opening long positions again only if a false breakout is formed. All purchases for a rebound are best deferred until the low at 1.2869 is updated or even lower, until the support test of 1.2836.

To open short positions on GBP/USD you need:

In the morning, sellers will try to break below the support of 1.2900, since consolidation below this level will strengthen the bearish trend and lead to the renewal of the 1.2869 area, where I recommend profit taking. A further target for short positions will be a low of 1.2836, a test of which will mean the end of an upward trend. However, keeping the pair below the resistance of 1.2934 remains a more important task for pound sellers. The formation of a false breakout at this level will be an additional signal to open short positions in GBP/USD. However, in the absence of activity from the bears in this range, it is best to postpone selling until the larger resistance of 1.2966 is updated.

Signals of indicators:

Moving averages

Trading is carried out in the region of 30 and 50 moving average, which indicates the lateral nature of the market after an unsuccessful downward correction.

Bollinger bands

A break of the upper boundary of the indicator at 1.2935 will lead to a more powerful wave of growth in the British pound. In case of a downward correction, support will be provided by the lower boundary of the channel around 1.2900.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence – moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

The material has been provided by InstaForex Company – www.instaforex.com