Bitcoin Elliott Wave analysis for 25/02/2019

Bitcoin Elliott Wave analysis for 25/02/2019:

Impulsive development is not done, correction time in wave 2.

Technical market overview:

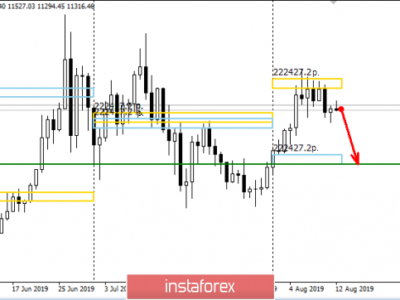

The ETH/USD pair has mad a new high at the level of $4,245 which was labeled as the top for the wave 5 and the top of the wave 1 of a higher degree. After that, the market suddenly reversed as the corrective cycle in wave 2 of the higher degree has started. For now, it is hard to say whether the last sudden drop was a full wave 2 or just a part of the wave 2 in form of a wave (a) of the lesser degree. It all depends on the wave (b) and the form it will take. The nearest resistance is seen at the level of $3,850 – $3,881 zone, but the bulls might break out higher towards the level of $4,000 before the wave (b) is completed.

Weekly Pivot Points:

WR3 – $4,708

WR2 – $4,470

WR1 – $4,118

Weekly Pivot – $3,886

WS1 – $3,537

WS2 – $3,284

WS3 – $2,810

Trading recommendations:

All long-term buy orders should be now closed as there is no good setup for entering this king of trade yet. Daytraders can try to open buy orders around the current price levels with a protective stop loss below the wave (a) low. The target is the resistance level of $3,881.

The material has been provided by InstaForex Company – www.instaforex.com